In terms of money, your credit score is one of the most important numbers. You might not be able to get credit cards, loans, mortgages, rental apartments, jobs, or even cell phone plans in some cases. Still, a lot of people don’t know what their real credit score is or how it’s done.

In this comprehensive guide we’ll explain everything you need to know about credit scores including

- What is a credit score and why it matters

- The difference between a FICO score and a VantageScore

- How credit scores are calculated

- The factors that impact your credit score

- How to check your credit scores for free

- How to improve a bad credit score

What Is A Credit Score?

A credit score is a three-digit number that summarizes your creditworthiness. It’s calculated based on the information in your credit report, which details your borrowing and repayment history.

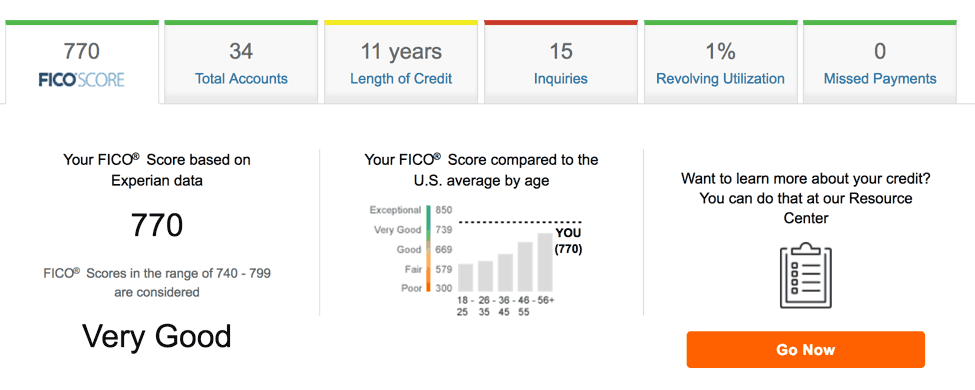

Credit scores range from 300 to 850. The higher the number, the lower the risk you pose to lenders. A score above 700 is generally considered good, while a score below 600 is poor.

Credit scores help lenders decide if they will lend you money and what interest rates to charge you. The better your credit score, the more likely it is that you’ll be approved and get better rates that save you money.

Credit checks can be done by anyone, not just lenders, when you apply for things like cell phone plans, rent, or insurance. If you have bad credit, you might have to pay more for services or be turned down for them.

FICO Score vs. VantageScore

There are two main companies that create credit scoring models: FICO and VantageScore.

FICO scores are the most commonly used. About 90% of the best lenders look at FICO scores when deciding who to lend money to. To give FICO scores, there are several models. The newest ones are FICO Score 8 and FICO Score 9.

VantageScore was created by the three major credit bureaus – Experian, TransUnion, and Equifax. It’s used by some lenders but less widely than FICO. The current VantageScore model is VantageScore 4.0.

While both score types use a 300-850 scale and consider similar credit report factors, the scores can differ because their formulas and underlying data are different.

It’s ideal to check both your FICO and VantageScores to understand how lenders may view your creditworthiness.

What Impacts Your Credit Score?

FICO and VantageScore models analyze the same five categories of your credit report to calculate your score:

-

Payment history (35% of score): Whether you pay your bills on time. Late payments lower your score.

-

Credit utilization (30%): How much of your available credit you’re using. High utilization hurts your score.

-

Credit history length (15%): How long you’ve had credit. A longer history boosts your score.

-

New credit (10%): Opening new accounts may lower your score temporarily.

-

Credit mix (10%): Having different types of credit (credit cards, loans, etc.) can help your score.

These percentages reflect how important each factor is in determining your overall score. Paying bills on time and keeping credit card balances low are critical for a high credit score.

Other factors like income, age, where you live, and number of inquiries on your report can also influence your score but to a lesser degree.

How To Check Your Credit Scores For Free

You can check your credit scores for free through:

-

AnnualCreditReport.com: Provides your free annual credit reports from Equifax, Experian, and TransUnion. Your reports won’t include scores but will show what’s impacting your scores.

-

Credit card issuer websites: Many issuers like Capital One and Discover provide free monthly access to your credit scores.

-

Credit monitoring services: Companies like Credit Karma offer free credit scores and reports with registration. Upselling often occurs.

-

FICO website: Provides a free FICO Score based on your Equifax data. No credit card required.

For full access to FICO Scores from all three bureaus, you’ll need to pay for a premium plan on MyFICO.com, which starts at $19.95/month. This gives you the most accurate view of your scores.

VantageScores are also available for purchase on credit monitoring sites, but free options are limited.

Checking your own credit will never hurt your scores. Soft inquiries that lenders use to pre-screen don’t impact your credit either. Only hard inquiries from applications for new credit will lower your scores slightly.

How To Improve A Bad Credit Score

If you have a low credit score, take these steps to improve it:

-

Pay all bills on time. Set up autopay or reminders to avoid missed payments.

-

Keep credit card balances below 30% of the limit. Pay down balances aggressively.

-

Don’t close old credit cards as it hurts length of credit history.

-

Limit new credit applications to avoid too many hard inquiries.

-

Correct errors on your credit reports by disputing them.

-

Become an authorized user on someone else’s old credit card to benefit from their history.

-

Use secured credit cards if you can’t qualify for unsecured cards yet.

Results won’t happen overnight. Consistently good financial habits can improve your scores significantly in six months to a year. Be patient and check your credit reports regularly to monitor your progress.

The Takeaway

Understanding and monitoring your credit score is crucial for your financial well-being. There are resources to check your FICO and VantageScores for free. Improving bad credit scores takes diligence over time, but the higher interest rates and opportunities you’ll unlock make it well worth the effort.

With this guide, you now have the key facts about credit scores and actionable steps to get your true credit score and maximize it. Let your new credit score knowledge empower you to achieve your financial goals.

Can I talk to a nonprofit counselor about my credit score?

Nonprofit credit counselors and housing counselors trained by the U.S. Department of Housing and Urban Development can often provide you with a free credit report and score and help you review them.

Can I check my credit card or other loan statements for my credit score?

Many major credit card companies and other lenders provide credit scores for their customers. The score could be listed on your monthly statement or can be found by logging in to your account online.

What Is My True Credit Score? – CreditGuide360.com

FAQ

How do I check my credit score for free?

There are several ways to review your score for free, however. The first place you should check for your free FICO Score is with your credit card issuer. Many provide cardholders with free access to their credit score. The key is knowing whether it’s your FICO Score or VantageScore.

How do I get my credit score?

You can get your credit score from a credit card or loan statement, a non-profit counselor, or a credit reporting agency for a fee.

Where can I Find my FICO score?

If you’d like to know what your FICO Scores are, you can checkout where to get FICO Scores here. Did you know you can get free credit reports? Experian, Equifax and TransUnion all provide free credit reports – learn how to get your report.

How can I get my FICO ® score for free?

There are several ways to get your FICO ® Scores, both for free and at a cost. Hundreds of banks, credit unions, credit card issuers, and credit counselors are part of the FICO ® Score Open Access program and offer free scores to customers. This means that you can get your FICO ® Score for free.

What credit score do I get if I check my credit?

When you check your credit, you’ll likely receive either a FICO ® or VantageScore credit score. Your score will depend on the scoring model used and the credit report that is being looked at, since most credit reports aren’t the same.

How are credit scores calculated?

Your credit scores are calculated based on the information in your credit history. This means it’s important to review your credit reports. You can view and request your credit reports weekly, at no cost to you, at www.AnnualCreditReport.com . Errors on your credit reports can reduce your scores unnecessarily. You have more than one credit score.

How do I find out my true credit score?

Where can I get my exact credit score?

You can check your CIBIL Score for free through the official CIBIL website or through authorized partners who offer free score checks. Is CIBIL Score of 750 Considered Good? Yes, a CIBIL Score of 750 is considered excellent. It signifies a very strong credit history and increases your chances of loan approvals.

What is the most reliable source of credit score?

Which credit bureau is the most accurate? Experian®, Equifax®, and TransUnion®, each of the three main credit bureaus, offer equally helpful and accurate information that can help you make informed financial decisions.Jun 19, 2024

What credit score does an 18 year old start with?