It is important to have a good credit score in order to get loans and credit cards with good terms. But what exactly is a “good” score? Is a 711 credit score enough to get the best rates and products?

In this comprehensive guide, we’ll explain what a 711 credit score means, whether it’s considered good or bad, and most importantly—how you can improve it.

What is a Good Credit Score?

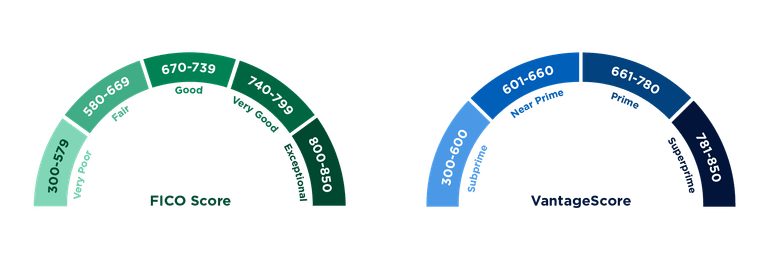

Credit scores generally range from 300 to 850. The FICO scoring model and VantageScore, two of the most commonly used credit scoring systems, categorize scores as follows

- Exceptional: 800-850

- Very Good: 740-799

- Good: 670-739

- Fair: 580-669

- Poor: 300-579

So by these standards, a 711 credit score falls into the “good” range. But whether that’s good enough depends on your goals.

While a score of 711 is sufficient for approval on most loans and credit cards, it’s on the lower end of the “good” spectrum. You likely won’t qualify for the very best rates and terms reserved for those with “very good” or “exceptional” credit.

What Does a 711 Credit Score Mean?

Lenders will see that you’re a pretty low-risk borrower who pays back their debts on time if your credit score is 711. But there may be some things in your credit history that you should be aware of, such as:

- Occasional late payments

- High balances on revolving credit accounts

- Limited history of managing different types of credit

- A past collection or public record that hasn’t yet fallen off your reports

If your credit score is 711, you’ll probably be approved for most types of credit. However, you might not always get the best terms or lowest interest rates.

Is a 711 Credit Score Good or Bad?

Whether a 711 credit score is good or bad depends on your financial goals and needs:

-

Good for: Getting approved for most credit cards and loans. Qualifying for average mortgage rates. Renting an apartment.

-

May be challenging for: Getting top-tier credit cards with the best rewards and perks. Securing the lowest auto and mortgage interest rates.

Overall, a 711 credit score is on the higher end of “average” for U.S. consumers. It indicates that your credit is in decent shape, but improving your score could open up better opportunities.

About 21% of Americans have credit scores in the 711 range. The average U.S. credit score is 714, so a 711 is very close to normal.

How to Improve Your 711 Credit Score

Here are some tips for boosting your 711 credit score into the “very good” range:

-

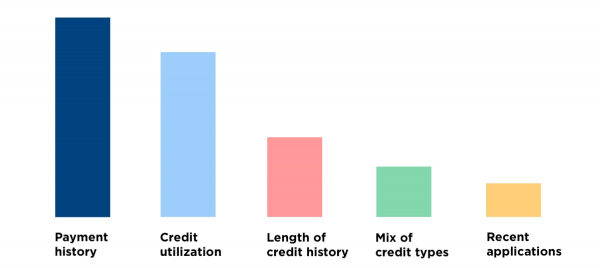

Pay all bills on time. Payment history is the most important factor, making up 35% of your FICO score. Set up automatic payments or reminders to avoid late payments.

-

Keep credit card balances low. Ideally, keep balances below 30% of your credit limit on each card and across all cards. This credit utilization ratio makes up 30% of your score.

-

Allow credit history to age. The longer your accounts have been open, the better. Maintain your old accounts instead of closing them.

-

Limit new credit applications. Opening multiple new accounts can lower your score temporarily. Wait at least six months between applications.

-

Correct errors on your credit reports. Mistakes can drag down your score. Dispute any inaccuracies with the credit bureaus.

With consistent good credit habits over time, you can inch your score up into the “very good” zone and qualify for better rates. Be patient, as it takes diligent effort to rebuild credit.

How a 711 Credit Score Impacts Your Borrowing Power

While a 711 credit score gives you access to most lending products, you won’t always get the cream of the crop terms. Here’s how a 711 score could affect your interest rates and approval odds for different types of credit:

Mortgages

-

Conventional loans – A 711 score meets many lenders’ minimum requirements. But scores of 740+ are ideal for the lowest rates.

-

FHA loans – You can qualify with a minimum 580 score. A 711 score makes you a very competitive borrower.

-

VA loans – No minimum score, but a 711 will help you meet income and debt requirements.

-

USDA loans – These loans for rural borrowers have no minimum score. Your 711 makes you a strong applicant.

Auto Loans

-

A 711 score is sufficient for approval from most lenders and dealerships. But excellent credit (740+) can save you significantly on interest.

-

Shop around for the best rates. Compare offers from banks, credit unions, and online lenders beyond just the dealership.

Credit Cards

-

Rewards cards – A 711 score meets requirements for most travel and cash back cards, but not ultra-premium cards.

-

Balance transfer cards – You’ll qualify for many 0% intro APR offers, but may need 740+ for the longest terms.

-

Special financing – Store cards and others may approve you, but won’t offer their lowest promotional rates.

Personal Loans

-

Your 711 score is high enough to pre-qualify with most online lenders and credit unions. Expect reasonable rates.

-

Those with “excellent” credit get the largest loans and lowest rates. But a 711 still gives you good options.

How Long Does it Take to Improve from 711 to 750?

It typically takes at least six months of consistent positive credit habits to boost your score from the low 700s to 750. Factors like your specific credit history and the scoring model used will determine exactly how long it takes.

Patience and diligently maintaining good financial behaviors are key. There’s no quick fix for substantially raising your score.

Within three to six months, you may see a modest score increase by lowering balances, paying bills on time, and avoiding new applications. But allow at least nine months to a year to improve 100 points or more.

The more proactive you are in managing your credit, the quicker you’ll reach your goal. Regularly monitoring your scores, disputing errors, and optimizing credit habits will get you there faster.

Summing Up: Is a 711 Credit Score Good?

A 711 credit score is right on the borderline between “good” and “very good.” It shows lenders you’re a dependable borrower, but doesn’t unlock the very best terms.

With some diligent effort, you can nudge your 711 score up toward 750 or higher. Doing so can save you thousands on interest costs over time. Monitor your credit, develop positive habits, and be strategic with new accounts.

While a 711 score gives you solid borrowing options, improving it further expands your opportunities. Use the tips in this guide to build an exceptional score and maximize your financial health.

What factors affect your credit scores?

Your credit score is shaped by five key factors — but not all of them carry equal weight. Understanding how each one works can help you focus your efforts where theyll make the biggest difference.

What are the credit score ranges?

There are two companies that dominate credit scoring, FICO and VantageScore, and they use models that vary. Both use a credit score range of 300 to 850, but they have different ranges and call those ranges by different names. These are the general guidelines:

Because of these differences, here are some general guidelines for credit ranges:

- Excellent credit: Any score in the high 700s or higher.

- Good credit: Any score from the mid-600s to mid-700s.

- Fair credit: Any score in the mid-500s to low 600s.

- Poor credit: Any score between 300 to high 500s.

Is 711 Credit Score Good? – CreditGuide360.com

FAQ

What does a 711 credit score get you?

A credit score of 711 is considered excellent and indicates to lenders that you are highly likely to repay your debts responsibly. As a result, lenders are more inclined to offer you personal loans with competitive interest rates and flexible repayment terms.

Can I buy a house with a 711 credit score?

Can I get a car with a 711 credit score?

With a median credit score of 711 for all auto loan consumers, the national average interest rate is 5. 27% on a 60-month car loan. For reference, the annual percentage rate (APR) ranges from 3% to 10% for auto loans.

How rare is a 750 credit score?

A credit score of 750 is considered “very good” and is above the average credit score in the United States. While it’s not as rare as an exceptional score of 800 or higher, it still places you in a relatively strong position with lenders.