In terms of money, your credit score is one of the most important numbers. It changes your chances of getting credit cards, loans, mortgages, rental applications, and other things. It also changes the terms and interest rates you’ll be offered. That’s why it’s so important to know what has the most effect on your credit score.

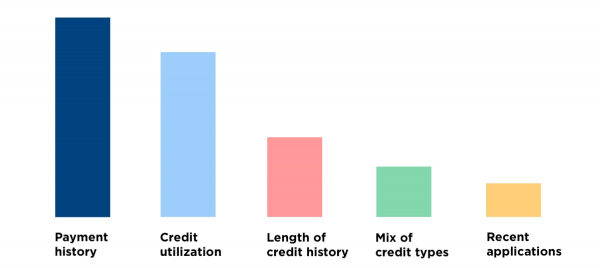

After analyzing the leading credit scoring models FICO® and VantageScore® three major factors emerge as having the biggest influence on your credit score

1. Payment History

How you’ve paid your credit accounts in the past has the single biggest impact on your credit score, Payment history makes up 35% of your FICO® score and 40% of your VantageScore®,

Every month that you make on-time payments is a positive mark on your credit history. But if you miss payments, pay late, or have any accounts sent to collections, it can severely damage your credit. Just one 30-day late payment can drop your score by 50-100 points.

To maximize this important factor:

- Pay all credit accounts on time every month

- Set up autopay or reminders to avoid missed payments

- Don’t let any accounts fall into delinquency or collections

In order to build a good credit score, it is important to aim for a perfect payment history over time.

2. Credit Utilization

Your credit utilization ratio compares how much credit you’re using against your total available credit limits. It makes up 30% of your FICO® score and 20% of your VantageScore®.

The lower your credit utilization, the better it is for your credit score. Experts recommend keeping your utilization below 30%, and the highest scores tend to have utilization under 10%.

You can improve your utilization quickly by:

- Paying down balances, especially on high limit cards

- Asking for credit limit increases

- Opening a new account to increase total limits

Getting your utilization as low as possible will maximize this key scoring factor.

3. Credit History Length

Three out of the five factors that make up your FICO score are length of credit history, which makes up the third largest factor. In general, the longer your credit history, the better.

You can build this factor over time by:

- Keeping old credit accounts open (as long as there’s no annual fee)

- Letting closed accounts age on your reports (they remain for 10 years)

- Becoming an authorized user on someone else’s long history account

While you can’t speed up time, avoiding account closures preserves your credit history length.

Other Important Credit Score Factors

While the above three factors have the most weight, other elements contribute to your credit score as well:

-

Credit mix – Having a variety of credit types, like mortgages, credit cards, student loans, etc. This is 10% of your FICO® score.

-

New credit—Getting a lot of new credit at once can slow down your score for a short time. This is 10% of your FICO® score.

-

Credit inquiries – Each application for credit results in a hard inquiry, which can lower your score a few points. Shopping for mortgages or auto loans within a short period counts as one inquiry.

Though smaller components, these other factors are still worth being aware of as you manage your credit.

Tips for Improving Your Credit Score

Now that you know what impacts your credit score the most, here are some tips for improving it:

-

Check your credit reports and dispute any errors. Mistakes can negatively affect your score.

-

Become an authorized user on a credit card with good standing to benefit from its history.

-

Limit new credit applications to avoid too many hard inquiries.

-

Ask for credit line increases over time to keep utilization low.

-

Create a budget to ensure you can make timely payments each month.

-

Use balance transfer or personal loans to consolidate high credit card balances.

-

Sign up for credit monitoring to stay on top of your reports and scores.

-

Be patient. Building credit takes time. Stick to good habits.

Focus on the major factors like payment history and utilization, and your credit score will steadily improve. Monitor your progress so you know how your actions impact this influential number.

The kinds of credit you have, or credit mix

Its best to have a mix of installment accounts — those with a set number of equal payments, such as car payments or mortgages — and credit card accounts.

- What to do: Having a good mix of at least five accounts is a sweet spot for credit scoring. Anything less can create a thin credit file, which can make generating a score difficult. Having this goal in mind as you’re building credit can strengthen your score.

What affects your credit scores the most?

The two major scoring companies in the U.S., FICO and VantageScore, differ in how they weight the factors in the calculations, but they agree on the two factors that are most important: Payment history, or your record of paying your bills on time, and credit utilization, which is the portion of your credit limits that you actually use. Together, these two factors make up more than half of your credit scores.

Heres a breakdown of all the factors that affect your scores:

The Three Biggest Factors That Impact Your Credit Score

FAQ

What has the highest effect on credit score?

Payment history: The biggest factor in determining your credit score is payment history. Every time you pay a credit card bill, car payment, house payment, student loan payment, etc. , it gets added to your history. It’s important that all of your payments are paid before the due date listed on your statement.

What is the biggest factor on credit score?

Payment history — whether you pay on time or late — is the most important factor of your credit score making up a whopping 35% of your score.

Which activity has the greatest impact on your credit score?

Payment history (35%): Payment history is the most important factor in your FICO Score and shows how you’ve managed your debt payments over time. Amounts owed (30%): FICO Scores focus on your credit utilization, or the amount of revolving credit you use, especially with credit cards.

What has the biggest impact on your credit score on EverFi?

Which factors affect your credit score? 35% of your score is based on your payment history; always make your payments on time! 30% of your score is based on how much credit you owe; this is also known as credit utilization and means that the more credit you’ve used compared to how much credit you have, the lower your score may be.