Your credit score plays an important role when you apply for a car loan. While there is no minimum credit score required by law, most lenders have their own minimum requirements. So is 683 a good credit score to buy a car? Let’s take a closer look.

What is a Good Credit Score for Buying a Car?

Most lenders consider a credit score of 661 or higher to be good when applying for a car loan. Borrowers with scores in this range are seen as lower risk and tend to get approved for financing at competitive interest rates

According to Experian, individuals with credit scores of 661 or higher are eligible for 66% of auto loans. Your chances of getting better terms go up as your score goes up.

Where Does a 683 Credit Score Fall?

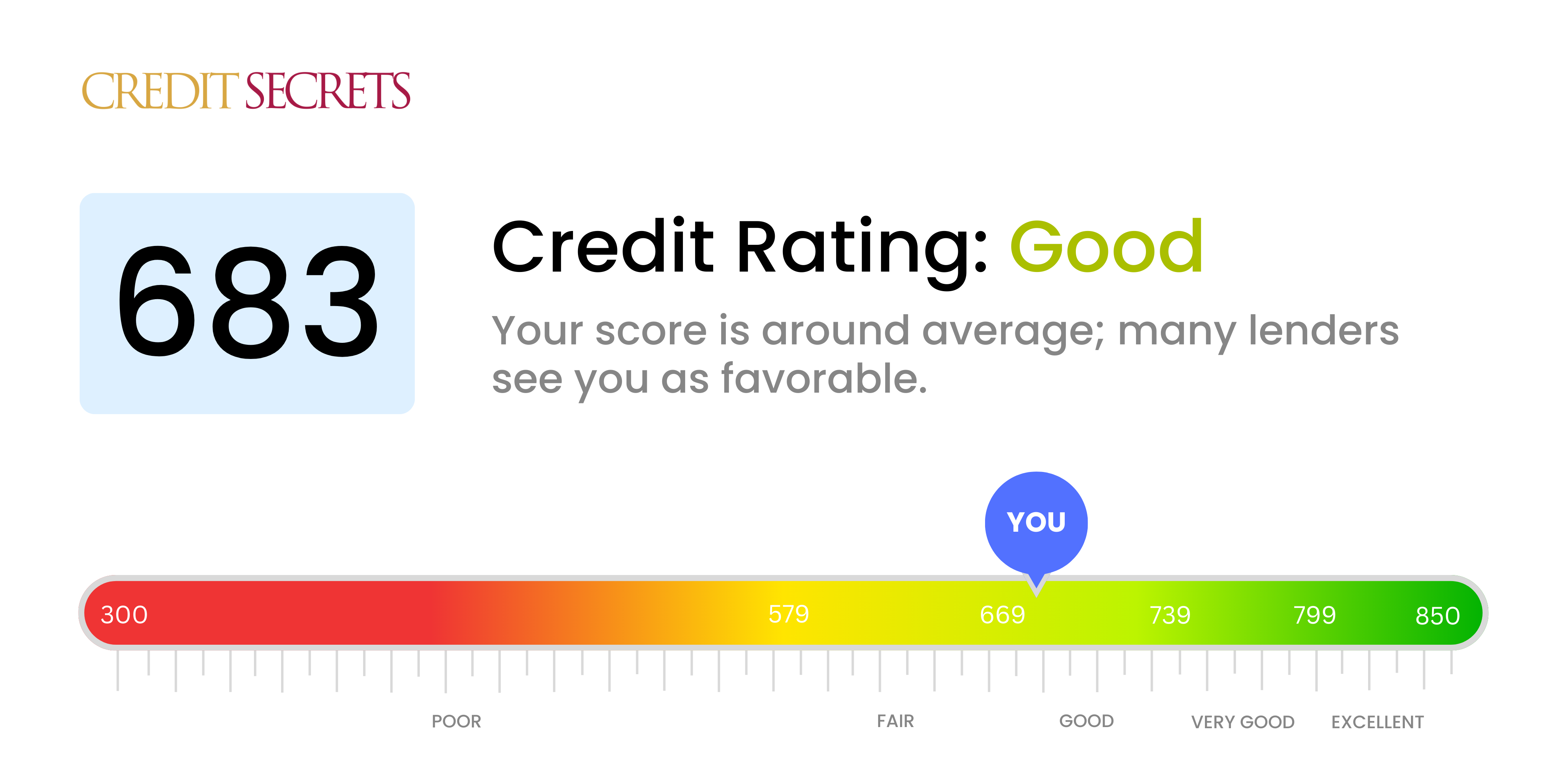

A 683 credit score falls in the good to excellent range, according to both the FICO and VantageScore models:

-

FICO scores A 683 is considered good (670-739)

-

VantageScores: A 683 falls in the good range (661-780).

So a 683 credit score exceeds the minimum requirements set by most lenders. With this score, you should be able to qualify for an auto loan without too much difficulty.

What Kind of Auto Loan Terms Can You Expect with a 683 Credit Score?

While every lender is different, here are some general guidelines on the loan terms you can expect with a 683 credit score:

-

Interest rates: Approximately 4-7% for a new car, 6-10% for a used car

-

Approval odds: Very good

-

Down payment required: Typically 10-20%

With a 683 score, you should qualify for competitive interest rates reserved for borrowers with good credit. You likely won’t need to put down a large down payment either.

Just keep in mind that factors like your income, existing debts, and loan term will also impact the terms you’re offered. But your 683 credit score puts you in a great starting position.

How Does a 683 Credit Score Compare to Other Ranges?

Here’s how a 683 credit score stacks up against other ranges:

-

760+ (Excellent credit): Lowest interest rates (as low as 2-4% for new cars) and best terms. Little to no down payment required.

-

700-759 (Good to Excellent): Competitive interest rates around 4-6% for new cars and 6-8% for used. 10-20% down payment.

-

683 (Good): Slightly higher interest rates of 4-7% for new and 6-10% for used. 10-20% down typically needed.

-

661-682 (Fair to Good): Interest rates from 5-8% for new and 8-12% for used cars. 20-30% down payment often required.

-

660 and under (Poor/Fair): Loan approval difficult. Higher interest rates from 8-14% or more. Large down payment of 30%+ usually needed.

As you can see, a credit score of 683 puts you in a great spot to get approved and secure reasonable loan terms. But there is still room for improvement into the excellent credit range.

Tips for Improving Your 683 Credit Score

If your goal is to get the very best rates, you may want to work on boosting your credit score even more. Here are some tips:

-

Reduce the amount of credit you use by keeping credit card and other revolving credit balances low. 30% or less of the limit is ideal.

-

Pay your bills on time. Your payment history is what determines your score the most. Avoid late payments.

-

Limit hard inquiries: Too many applications for new credit can lower your score temporarily. Only apply for what you need.

-

Correct errors: Dispute and remove any inaccuracies on your credit reports.

-

Increase credit history: Letting your accounts age and not closing old ones can help.

It’s likely that you can raise your credit score from 683 to over 700 with time and careful credit management. This opens the door to even better loan terms.

The Bottom Line

A credit score of 683 is considered good and exceeds the minimum requirements for most auto lenders. With proper research, you should be able to qualify for a competitive interest rate around 4-7% and potentially get approved with a 10-20% down payment.

While not in the “excellent” range, a 683 credit score puts you in a great starting position when applying for a car loan. By maintaining healthy credit habits, you may be able to improve your score over time and get access to even better rates. But for most borrowers, a 683 FICO score is sufficient to get approved for financing and purchase a new or used car.

Can I get a personal loan with an 683 credit score?

You can get a personal loan with an 683 credit score, but not every lender may approve you. Some lenders require scores well into the 700s for consideration. However, depending on the lender, you may get a personal loan with rather competitive terms.

Upstart-powered personal loans are designed primarily for borrowers who may not have top-tier credit but are considered credit-worthy based on non-traditional variables, so you may want to consider checking your loan offers if you’re in the market.

Can I get a credit card with an 683 credit score?

The short answer is yes. You should be able to get a standard (non-secured) credit card with a FICO Score in the realm of good credit scores. Having said that, there are a couple of big caveats.

For one thing, you aren’t likely to qualify for some of the best credit card offers in the market. To get the best rewards credit cards, balance transfer offers, and best 0% APR offers, lenders may want to see excellent credit, with scores significantly higher than yours. You also might not get as high of a credit limit as consumers with higher scores.

Second, your credit score is just one part of the credit card approval process. Lenders will also take your other debts and employment situation into consideration. In fact, it’s not uncommon for consumers in the elite credit tiers to get rejected because their other debts are a bit too high.

What Credit Score Do Car Dealerships Use? (Which Credit Bureau Is Most Used for Auto Loans?)

FAQ

Can I buy a car with a 683 credit score?

The credit score required and other eligibility factors for buying a car vary by lender and loan terms. Still, you typically need a good credit score of 661 or higher to qualify for an auto loan. About 71% of vehicle financing is for borrowers with credit scores of 661 or higher, according to Experian. Mar 18, 2025.

What can a 683 credit score get you?

People with a credit score of 683 may still be able to get loans and other forms of credit, but they may have to pay more in interest or have fewer options than people with higher credit scores.

What credit score do you need to buy a $30,000 car?

To qualify for a $30,000 car loan, most lenders prefer to see a credit score of at least 660 to 700. That being said, your credit score is only one part of the equation. Lenders will also consider: Your debt-to-income ratio (how much you owe compared to how much you earn).

What is an excellent credit score to buy a car?

According to Experian, a target credit score of 661 or above should get you a new-car loan with an annual percentage rate of around 6. 70% or better, or a used-car loan around 9. 06% or lower. Superprime: 781-850.