There are many reasons you might want to close a bank account, such as switching banks, combining accounts, or just not needing it anymore. Before you close that account, though, you may be wondering: Will it hurt my credit?

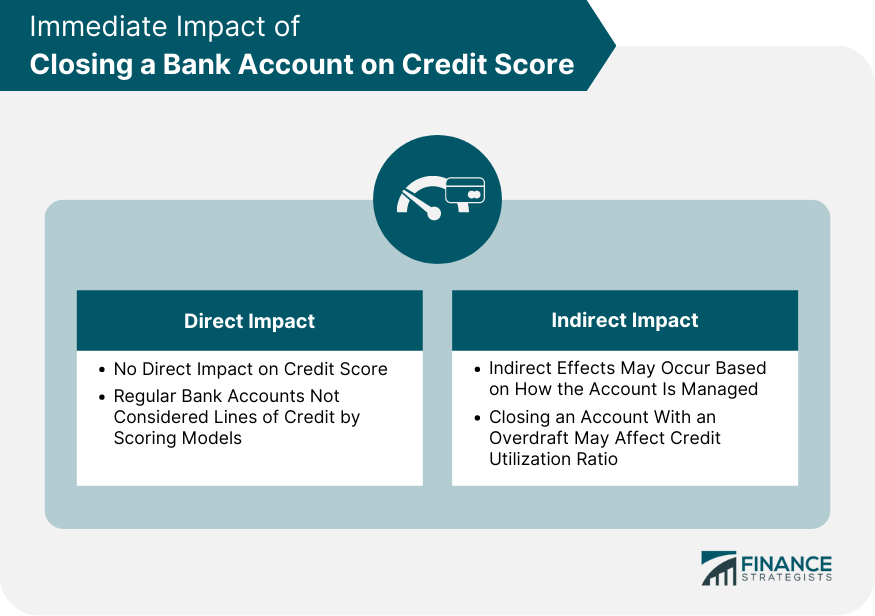

In short, closing a bank account does not have a direct effect on your credit scores. But closing an account the wrong way can hurt your credit score in some indirect ways. In this article, we’ll talk about how bank accounts affect your credit, when closing an account might hurt your scores, and how to close an account without hurting your credit.

How Bank Accounts Relate to Your Credit

First, it’s important to understand the relationship between bank accounts and your credit reports and scores

Your credit reports, maintained by the three major credit bureaus, Experian, Equifax, and TransUnion, track your history managing credit – including credit cards, loans, mortgages, etc. Your credit scores are calculated based on the information in your credit reports.

Your bank account history and activity is not reported to the credit bureaus. Things like opening or closing accounts, deposits, balances, or overdrafts are not included in your reports.

So closing a bank account won’t have a direct effect on your credit score. Getting rid of an account won’t hurt your credit score or show up on a credit report.

However, there are some indirect ways that closing an account could affect your scores, which we’ll get into next.

When Closing a Bank Account Could Hurt Your Credit

There are some situations where closing an account could hurt your credit report, but closing the account itself won’t hurt your credit.

-

The account has a negative balance – If you close an account that has a negative balance due to overdrafts and fees, the bank may send the debt to collections. That collection account could then be reported to the credit bureaus and lower your scores.

-

You miss a loan payment – If automatic payments for a loan, mortgage, or credit card are withdrawn from the account, closing it without switching over the payments could result in a missed payment and credit damage.

-

You have a relationship with the bank – Some banks may view account relationships positively when reviewing applications for credit cards or loans. Closing your accounts could remove this potential advantage.

The key is avoiding these pitfalls when you close your account. We’ll explain how next.

How to Close an Account Without Hurting Your Credit

Closing your account properly involves a few simple steps to protect your credit scores:

-

Open a new account first – Have a new account ready at another bank so you have a place to move your money and bill payments.

-

Transfer automatic payments – Update any bills, subscriptions, or automatic loan payments to come out of your new account.

-

Pay off balances – Settle any negative balances or overdrafts so the account has a zero balance when closed.

-

Confirm account closure – Request written confirmation from the bank that your account is fully closed with no other pending actions.

Following this checklist will allow you to seamlessly switch banks and accounts without any unintended hits to your credit.

If you do get a collection account on your credit report from a closed bank account, you can dispute the item with the credit bureaus to potentially get it removed. Paying off the negative balance won’t remove it from your credit reports, but some newer credit scoring models may ignore paid collections when calculating your scores.

Closing Joint Accounts

If you share a bank account with another person, such as a joint checking account with your spouse, extra steps should be taken when closing the account to avoid issues.

Both account holders should agree in writing to close the joint account. Any remaining funds should be withdrawn and distributed evenly, or as agreed upon. The other account holder should also be notified so automatic payments can be switched to a new account if needed.

With joint accounts, you’ll likely need to visit a branch or mail in a form to complete the closure, rather than closing it online. This ensures the bank receives authorization from both account holders.

Alternatives to Closing an Account

If you don’t want to fully close your bank account, here are some other options to consider:

- Switch to a free, basic checking account to avoid monthly fees

- Negotiate with the bank to waive or reduce fees on your existing account

- Keep the account open but minimize activity to avoid dormancy fees

This allows you to preserve your relationship with the bank and account history while reducing costs.

When Is Closing an Account a Good Idea?

While closing a bank account doesn’t directly hurt your credit, there are plenty of good reasons you may want to do so. Here are some of the most common:

- You’re moving, and your bank doesn’t have branches in your new area

- Your bank charges high monthly fees or overdraft fees

- You find a new bank offering better interest rates or lower fees

- You no longer need multiple accounts and want to consolidate

- You’re unhappy with the bank’s customer service

As long as you close properly by settling balances, transferring payments, and confirming account closure, you can switch banks or consolidate accounts without credit concerns.

The Bottom Line

While bank accounts aren’t directly connected to your credit, there are some roundabout ways that closing one improperly could ding your credit scores. As long as you close an account responsibly by paying balances, switching payments, and confirming closure, your credit shouldn’t be affected. But take precautions when closing joint accounts or ones with overdrafts.

Closing a bank account is a common occurrence when people move, switch banks, or consolidate finances. By understanding the relationship between bank accounts and your credit, you can take steps to ensure account closure doesn’t hurt your credit scores.

Does Bank Account Information Show Up on a Credit Report?

Banks and credit unions dont report your bank account information, including closures, to the credit reporting agencies (Experian, TransUnion and Equifax). As a result, any bank account you open or close wont be listed on your credit report.

Your credit reports are a record of how you manage your debt payments. Since your checking, savings and other deposit accounts are not reflected in your credit reports, theres no direct link between them and your credit scores.

You Have a Negative Balance

If you close the account with a negative balance and dont pay off the debt you owe in a timely manner, the bank or credit union could send it to a collection agency. The agency may choose to report the collection account to the credit bureaus, which can have a significant negative impact on your credit score.

Whats more, the collection account will remain on your credit report for seven years from the date of the original delinquency, even if you pay it off. Newer credit score models may ignore paid-off collection accounts when calculating your credit scores, however.

Will CLOSING A Bank Account HURT Your Credit Score?

FAQ

Will closing a bank account affect my credit score?

You should settle any debts with the bank before closing the account if you want to avoid fees. Your credit score will go down if you have a negative balance in your bank account or if you don’t pay your credit cards on time. Will closing unused bank accounts help my credit score?.

Can closing a bank or credit union account hurt your credit score?

If you want to close a bank or credit union account but also have a checking or savings account, you may be wondering if that will hurt your credit score. A low credit score can make it hard to get a personal loan, home loan, or car loan, and it may also make it hard to get credit cards in the future.

What happens if a creditor closes your account?

How a Creditor Closing Your Account Can Hurt Your Credit When an account is closed, , which impacts your credit-utilization ratio — the amount you owe as a percentage of your total available credit. This ratio accounts for 30% of your credit score. Keeping your balances around 30% or less of your available credit is best.

Can a closed credit card affect your credit score?

As TransUnion and Experian note, a closed account that shows a positive history of payments is likely to help your credit score. Generally, a closed account with negative history can continue to hurt your credit score for seven years. Is it good to have a zero balance on credit cards?

What happens if a bank account is closed?

Negative Marks: If the account was closed due to delinquency or other negative factors, these marks can remain on your credit report for up to seven years, potentially lowering your score. Positive Side: The good news is that the impact of a closed account diminishes over time.

Should you close a bank account after opening a new account?

Close the old account. After you open the new bank account, it’s a good idea to wait at least a month or so before closing the old one. This gives you a chance to make sure your direct deposit is rerouted successfully and all automated bill payments have been transferred. Closing a bank account that’s in good standing won’t hurt your credit score.

Will closing a bank account affect credit score?

Is there a downside to closing a bank account?

How badly does closing an account hurt your credit?

Closing one credit card account likely won’t make a big enough dent to hurt your chances of approval with future lenders, especially if you’ll still have another form of revolving credit open, but it’s worth being mindful of this if you want the highest credit score possible.

Does closing a bank account delete history?

Banks are required by federal regulations to retain certain account records, such as checks and electronic transfers, for set timeframes after an account is closed. For checks, this retention period is 5 years. Beyond those minimums, banks will often keep records of closed accounts for 7-10 years after closure.