It’s likely that most people don’t want to get their credit score to zero. However, some people may wonder if they can get rid of all of their credit history and start over brand new. It’s not possible to have a credit score of zero, that’s the short answer. This is why, and here are some tips on how to fix your credit after it starts to go down.

You Technically Don’t Have a Zero Credit Score

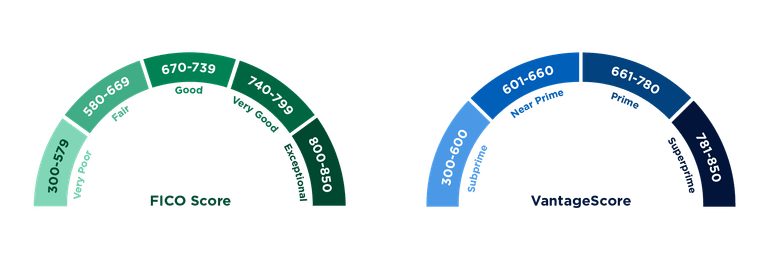

The most commonly used credit scoring models in the US are the FICO Score and VantageScore. Both of these scores range from 300 to 850 So there is no such thing as a zero credit score. Even someone with the worst credit behavior won’t have a score of zero

However, it is possible to not have a credit score at all. This happens when you have no credit history for the scoring models to evaluate. Situations where you might be “credit invisible” include:

- You’ve never had a credit account open in your name.

- You haven’t used credit for at least 6 months.

- You only recently applied for your first credit account.

So when you’re just starting to build credit, you don’t begin at zero – you start with no score. As you begin to establish a credit history, a score can be calculated based on your credit profile.

Your Starting Credit Score Isn’t the Lowest Possible

When you first get a credit score, it’s unlikely to be the bare minimum 300. Think about it – if you have no negative information on your credit reports yet, there’s no reason your score would start so low

Scores can’t just guess that you’ll be a risky borrower right away. You might end up being very good with credit after all. Since there is no past data to use to guess how you will act, new scores usually fall in the middle of the range.

As you start using credit, your actions determine whether your score goes up or down. Consistently making on-time payments and keeping credit card balances low will boost your score quickly. Missing payments or maxing out cards will send it plummeting.

Key Factors That Determine Your Credit Score

To understand how your credit score is worked out, you need to know what makes it up. Both the FICO and VantageScore models look at these five main things:

- Payment history – Whether you pay bills on time. This has the greatest impact on your scores.

- Credit utilization – How much of your available credit you’re using. Keep this below 30%.

- Credit history length – How long you’ve had credit accounts open. The longer your history, the better.

- Credit mix – Whether you have experience with different types of credit (credit cards, loans, etc.).

- New credit – How many new accounts you’ve opened and credit inquiries on your reports. Too many dings your score.

The importance of each factor varies slightly between scoring models. But the takeaway is, to build a solid credit score you need to:

- Make every payment on time.

- Keep credit card balances low.

- Allow accounts to age over time.

- Have a mix of credit types.

- Only open new credit when needed.

How to Check Where Your Credit Score Stands

Since you don’t start with a zero score, where do you begin? The only way to know is to check your credit score.

You can get your FICO Score from myFICO. com or from lenders and credit card companies with whom you already have accounts. Sites like Credit Karma provide VantageScores for free.

Checking your own score doesn’t hurt it. But having lenders make hard inquiries when you apply for credit dings the score temporarily.

Once you know your starting score, you can monitor your progress going forward. Tracking scores over time shows the impact your credit habits have.

Tips for Improving a Very Low Credit Score

If you already have a poor credit score, you may feel frustrated or hopeless about raising it. But no matter where you’re starting from, there are steps you can take to rebuild credit. Here are some tips:

- Get a secured credit card – This requires a refundable deposit and reports to credit bureaus like a regular card. Use it lightly and pay on time.

- Become an authorized user – Get added to a family member’s credit card responsibly. Their good history can help your score.

- Open a credit builder loan – These loans establish payment history and provide savings when paid off.

- Consolidate debt – If you have balances scattered across multiple cards, consolidate them with a personal loan. Make one monthly payment on time.

- Limit hard inquiries – Each credit application makes an inquiry, so only apply for accounts you need.

- Correct report errors – If your credit reports have mistakes, file disputes to improve your score.

- Wait for time to pass – Negative marks like late payments stay on your report for 7 years. As they age, the impact lessens.

The most vital step is making on-time payments. Payment history matters most! After establishing a positive track record, your credit score will steadily improve.

You Can’t Have a Credit Score of Absolute Zero

If needed, you can rebuild your credit from a low starting point by using secured cards or credit builder loans responsibly. Maintaining good financial habits over time will cause your score to gradually increase. But patience is required.

The journey may feel frustrating and slow at times. But with diligence, anyone can develop a strong credit profile and improve their financial opportunities.

What’s the starting point for your score?

Just as being new to credit doesn’t mean you start at zero, it also doesn’t mean you begin in the basement at 300. After all, if you’ve never had credit, you’ve never made score-devastating mistakes.

When you have no credit history, the credit bureaus just don’t know enough about you to guess whether you’ll pay back borrowed money. And that’s all a credit score is — an estimate of the likelihood you’ll pay back the next credit you’re granted, based on the data in your credit reports.

Once you begin using credit, scores can be calculated. You likely wont start with a good credit score but you won’t be at the bottom of the scale, either.

Why you don’t have a credit score

No one has a credit score of zero, no matter how badly they have mishandled credit in the past.

The most widely used credit scores, FICO and VantageScore, are on a range from 300 to 850.

Tommy Lee, a senior director at FICO, said scores of 300 are “extremely rare.”

Reasons you might not have a score are:

- You’ve never been listed on a credit account.

- You haven’t used credit in at least six months.

- You have only recently applied for credit or been added to an account.

How to RAISE Your Credit Score Quickly (Guaranteed!)

FAQ

How do I get my credit score to 0?

You can’t have a zero credit score but you can have no credit score. Learn why living without a credit score can make some financial goals harder to achieve.

Is it possible to have zero credit?

No one has a credit score of zero, no matter how badly they have mishandled credit in the past. The most widely used credit scores, FICO and VantageScore, are on a range from 300 to 850. Mar 31, 2025.

How rare is an 850 credit score?

An 850 credit score, often called a “perfect” score, is quite rare.

What credit score does an 18 year old start with?

A 600 FICO score, which is considered “fair,” is below the average credit score of individuals ages 18 to 26. The average 18-year-old has a 681 score. Dec 2, 2024.