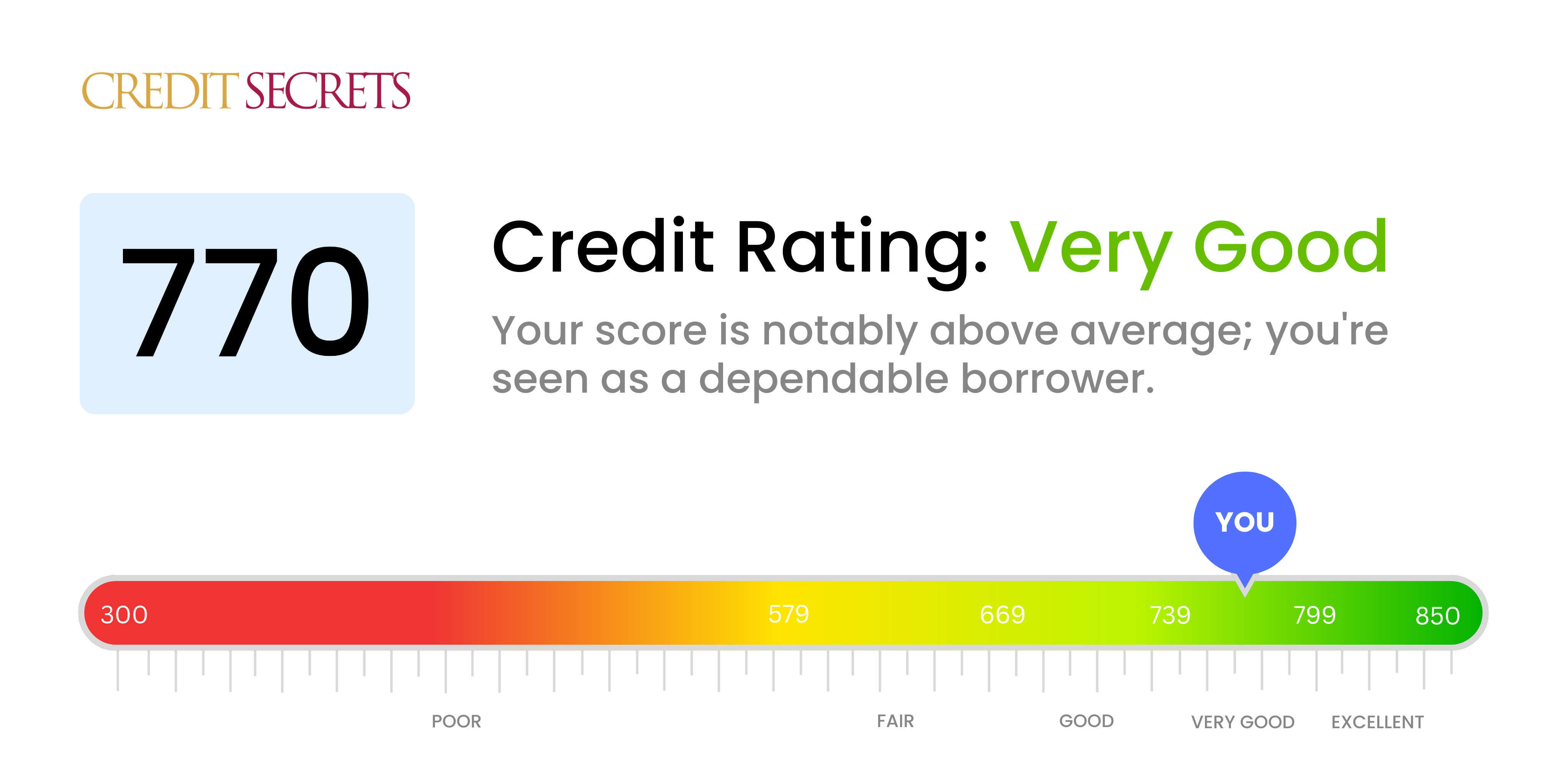

When lenders look at your credit applications, one of the most important things they look at is your credit score. Credit scores can be hard to understand, though, because they are based on different models and ranges. Your credit score may have been 770 when you checked it recently, which makes you wonder if that is a good score.

This guide will tell you everything you need to know about what a credit score of 770 means and how lenders see it. We’ll also give you advice on how to get and keep a score in this range.

An Overview of Credit Score Ranges

Before determining if 770 is a good score, it’s helpful to understand the different credit score ranges.

The two most commonly used credit scoring models are the FICO® Score and VantageScore®. Here’s how they break down credit scores:

FICO® Score Ranges

- 800-850: Exceptional

- 740-799: Very Good

- 670-739: Good

- 580-669: Fair

- 300-579: Very Poor

VantageScore® Ranges

- 781-850: Excellent

- 661-780: Good

- 601-660: Fair

- 500-600: Poor

- 300-499: Very Poor

So where does 770 fall?

Is 770 a Good Credit Score?

The FICO® model calls a score of 770 “Very Good,” while the VantageScore® model calls it “Good.”

Overall, a score of 770 is great and shows that you know how to handle your credit well. Lenders see people with scores in this range as less of a risk, so they offer the best interest rates and loan terms.

According to Experian data, only 25% of consumers have credit scores in the “Very Good” range. So a 770 score puts you well above average when it comes to creditworthiness.

Credit Opportunities with a 770 Score

A 770 credit score opens up many prime borrowing opportunities, including:

-

Low interest rates: You’ll qualify for the lowest interest rates on loans and credit cards – often under 10%. This can save you thousands on interest costs.

-

Ideal mortgage rates: A score above 740 is needed for the best mortgage rates. With 770, you’ll have your pick of competitive rates from multiple lenders.

-

Car loan approvals: Excellent credit vastly improves your chances of auto loan approval. You’ll also qualify for the lowest interest rates, usually under 5%.

-

Premium credit cards: Issuers offer their top rewards cards to consumers with Very Good/Excellent scores. You may qualify for cards with bonuses worth hundreds, travel perks, and other premium benefits.

-

Higher credit limits: Lenders are comfortable extending higher limits to borrowers with excellent credit. This helps keep utilization low.

While a 770 credit score provides many advantages, it’s not a guarantee of approval. Lenders also consider factors like income, existing debt, and loan purpose when making decisions. But overall, your strong credit gives you excellent approval odds in most scenarios.

How to Reach a 770 Credit Score

If your score is currently below 770, here are some tips to improve it:

-

Lower credit utilization – Experts recommend keeping utilization below 30%. The lower, the better.

-

Pay all bills on time – Payment history is 35% of your FICO® Score. Never miss payments.

-

Limit hard inquiries – Too many applications hurt your scores. Only apply for credit when needed.

-

Increase credit history age – Older accounts boost your score. Keep unused cards open.

-

Diversify credit mix – Manage different types of credit, including installment loans and credit cards.

With diligent credit management over time, a 770 score is certainly achievable for most people. Be patient and let your consistent good habits slowly boost your credit.

Maintaining a 770 Credit Score

Once you’ve reached this Very Good score range, you’ll want to keep it there. Here are some tips:

-

Monitor credit reports for errors that could hurt your scores. Dispute any inaccuracies found.

-

Be cautious about closing old credit cards as this can lower your history age.

-

Say no to department store cards you don’t really need. Too many inquiries and new accounts can damage scores.

-

Never miss payments as this can have a severe negative impact on your credit. Set up autopay if needed.

-

Keep utilization as low as possible on all credit cards. Consider making extra mid-cycle payments.

With vigilance and smart credit habits, maintaining your 770 score or going even higher becomes very achievable.

The Takeaway

A FICO® Score of 770 is considered Very Good and well above average. This grants access to prime rates from lenders, ideal financing offers, higher credit limits, and premium credit cards. While not a guarantee, this score significantly improves your approval odds for any credit application.

Both reaching and maintaining this excellent score range is feasible for most people through diligent credit monitoring and responsible habits over time. A 770 credit score demonstrates to lenders that you are a low-risk borrower and rewards you with the very best credit opportunities.

Space out credit applications

Avoid making several credit applications in a short time frame. Credit checks for the purpose of credit decisions can cause a small, temporary dip in your score, and several in a short time can add up. Thats why its important to research credit cards before you apply.

How to get a good credit score

If you want to improve your credit score, youll need to establish good credit habits and practice them consistently. Heres a list of financial habits that have the biggest impact on your score:

Is A 770 A Good Credit Score? – CreditGuide360.com

FAQ

What can a 770 credit score get me?

A 770 credit score can demonstrate creditworthiness to lenders and you are likely to qualify for competitive interest rates and terms. You may even be able to have opportunities to take out credit cards with more premium perks.

How do I increase my credit score from 770 to 800?

… to 800, you’ll need a nearly flawless payment history, a credit utilization rate well below 30%, a healthy mix of credit types, and an extended credit historyMay 2, 2025.

How rare is a 770 credit score?

| FICO® Score Range | Percent Within Range |

|---|---|

| 600-649 | 8% |

| 650-699 | 11% |

| 700-749 | 16% |

| 750-799 | 24% |

How to get 800 credit score?

And the “800 Club” is a lot easier to join. More than 40 million American consumers have 800 or better credit scores. Only 12 million are millionaires. And all you gotta do to join the 800 Club is pay every bill, every month on time and be ultra, ultra conservative about using a credit card for spending.