Getting a good credit score takes time and effort. Making on-time payments keeping credit card balances low and avoiding opening too many new accounts are just some of the things you need to do. So when you finally hit that 750 mark, is that considered a good FICO score? Let’s take an in-depth look.

What is a Good FICO Score?

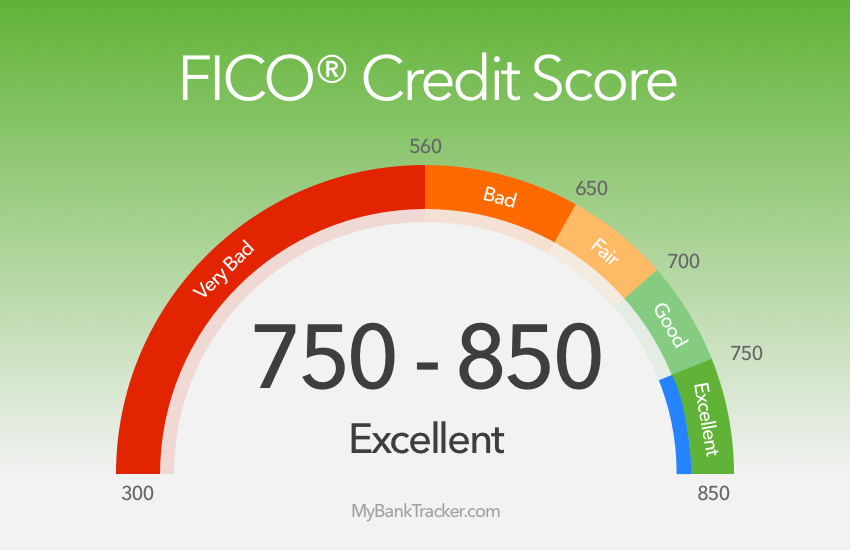

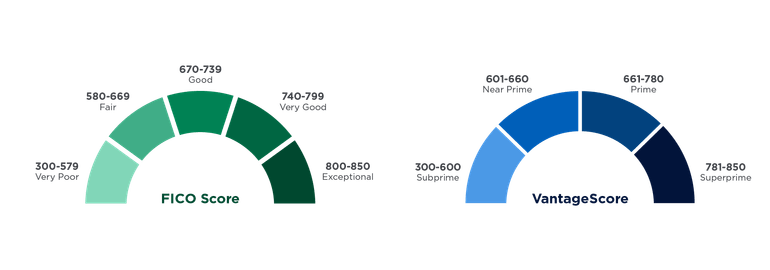

First, it’s helpful to know the ranges of credit scores. FICO scores, which are the most common, go from 300 to 850. Scores above 700 are usually good, and scores above 750 are very good.

According to Experian, here is how FICO scores breakdown:

- 800-850: Exceptional

- 740-799: Very Good

- 670-739: Good

- 580-669: Fair

- 300-579: Very Poor

A FICO score of 750 is in the “very good” range. It’s well above the norm, which means you’ll get the best interest rates from lenders.

What Percentage of People Have a 750 FICO Score?

Only 25% of people have credit scores in the “very good” range of 740-799, according to Experian. So scoring a 750 puts you well above average compared to other consumers.

Having this high of a score signifies that you have a proven track record of managing credit responsibly by paying bills on time, keeping balances low, and avoiding negative marks on your credit report.

What Can You Get with a 750 Credit Score?

A 750 credit score unlocks access to the top tier of lending offers. Here are some of the benefits of having this high of a score:

- Low interest rates: You’ll qualify for the very best interest rates on loans and credit cards, saving you money.

- Better terms: Lenders will offer you their top promotions, rewards, and features.

- High approval odds: Your application will sail through the approval process with a 750 score.

- Large loan amounts: You’ll be able to qualify for larger loans and higher credit limits.

- Refinancing deals: Many lenders will want your business to refinance existing loans.

In particular, a credit score of 750 can help you get approved for:

- Mortgages with 10% down or less

- 0% intro APR credit card offers

- Car loans under 4% interest

- Personal loans with low rates

- Premium credit card rewards programs

Is a 750 Credit Score Good for a Mortgage?

Absolutely! A credit score of 750 is considered excellent for mortgage lending. The average mortgage borrower has a score of 756, so 750 meets or exceeds what most homebuyers have.

If you have a FICO score of 750, you can choose from a wide range of mortgage products and get the lowest interest rates. This can help you save a lot of money over the loan’s term.

Most lenders require a minimum score of 620 for conventional mortgages and 580 for FHA loans. So a 750 credit score makes you a very attractive borrower who will sail through the approval process.

How to Improve Your 750 Credit Score

While a 750 credit score is in the “very good” range, there are still steps you can take to improve it further:

- Lower credit utilization: Keeping balances below 10% of limits can boost your score.

- Mix up credit types: Having both revolving (credit cards) and installment (mortgage, auto) helps.

- Don’t close old accounts: Having a longer credit history improves your score.

- Limit hard inquiries: Too many credit checks from applications hurts.

- Review reports closely: Dispute any inaccuracies found.

- Sign up for credit monitoring: This lets you track your score and catch issues early.

If you can get your credit score as close to 850 as possible, lenders will give you better deals.

How to Maintain a 750 Credit Score

Once you’ve reached the 750 mark, you’ll want to make sure you maintain it. Here are some tips:

- Always pay bills on time – set up autopay if needed.

- Keep credit utilization low, below 30% if possible.

- Don’t open too many new credit accounts. Space out applications.

- Monitor credit reports for errors and suspicious activity.

- Ask for credit line increases periodically to keep utilization low.

- Sign up for credit monitoring to stay on top of your score.

- Create a system to organize credit card and loan statements.

The Downside of a 750 Credit Score

Is there a downside to having a FICO score as high as 750? Not really, as long as you continue engaging in responsible credit habits. However, here are a couple things to be aware of:

-

You may get frequent offers for new credit. Be selective about accepting them to avoid unnecessary hard inquiries on your report.

-

Identity thieves target people with good credit. Monitor your reports and consider a credit freeze to protect yourself.

-

Lenders may lower your score if you don’t use credit for long periods. Make occasional charges to keep accounts active.

Overall though, a 750 credit score gives you access to the top tier of lending offers. Maintaining this high of a score takes diligence but is well worth the savings and perks you’ll receive over your financial lifetime.

Summary: Is a 750 FICO Score Good?

A FICO score of 750 is very good and considered excellent credit. Only 25% of people have credit scores this high.

Benefits of a 750 credit score include qualifying for the best interest rates, terms, and offers from lenders. You’ll have great approval odds for mortgages, auto loans, credit cards, and other financial products.

While it’s possible to improve from a 750 credit score, maintaining it over time should be your priority. Doing so requires regularly monitoring your credit, making on-time payments, keeping utilization low, and limiting hard inquiries on your report.

In the world of credit scores, a 750 is something to be proud of. It provides access to the top tier of lending offers which can save you thousands over your lifetime.

A 750 credit score can help get you the best rates on loans and credit cards

When your score is 750, you’re in a strong position to qualify for most financial products and get among the very best rates on them. A 750 credit score is considered excellent on commonly used FICO and VantageScore scales.

There are some exceptions; a high score by itself isnt always enough. The length of your credit history and how much debt you carry relative to your income also matter.

Is 750 a good credit score?

A 750 credit score is considered very good and above the average score in America.

Your credit score helps lenders decide if you qualify for products like credit cards and loans, and your interest rate. A score of 750 puts you in a strong position.

Why You NEED a 750 Credit Score

FAQ

Is a FICO ® score of 750 a good credit score?

A FICO ® Score of 750 is well above the average credit score of 714, but there’s still some room for improvement. Among consumers with FICO ® credit scores of 750, the average utilization rate is 18. 5%. The best way to determine how to improve your credit score is to check your FICO ® Score.

Can a 750 credit score qualify for a loan?

Borrowers with credit scores in the Very Good range should have no issues qualifying for a loan or credit card. With a credit score of 750, your focus should be maintaining your credit status to make sure you continue to get the most favorable loan terms available.

How do I get a 750 credit score?

To get a 750 credit score, you need to pay all bills on time, have an open credit card account that’s in good standing, and maintain low credit utilization for months or years, depending on the starting point. The key to reaching a 750 credit score is adding lots of positive information to your credit reports.

Is 750 a good credit score to buy a house?

A 750 credit score is well above the minimum credit score needed to buy a house, by most lenders’ standards. You are likely to qualify for the lowest interest rates on a mortgage. Even though you already have good credit habits, there are things you can do to keep it that way and maybe even raise it: set up automatic payments.

How can i Improve my 750 credit score?

Borrowing Options: Most borrowing options are available, and the terms are likely to be attractive. For example, you might be able to qualify for the best credit cards and the best personal loans. Best Way to Improve a 750 Credit Score: Reducing the credit utilization on your credit card accounts could quickly boost your score.

What is the average utilization rate for a 750 credit score?

Among consumers with FICO ® credit scores of 750, the average utilization rate is 18. 5%. The best way to determine how to improve your credit score is to check your FICO ® Score. Along with your score, you’ll receive information about ways you can boost your score, based on specific information in your credit file.

What will a 750 credit score get you?

A credit score of 750 is usually thought to be very good, and it can help you get the best loan terms and credit card offers.

Is there a big difference between 750 and 800 credit scores?

A 750 credit score is Very Good, but it can be even better. If you can raise your score to the “Exceptional” range (800–850), you may be able to get the best loan terms, such as the lowest interest rates and fees, and the best credit card rewards programs.

What is a good FICO score?

What percentage of people have a FICO score over 750?

Twenty-four percent have a FICO® Score between 750 and 799, making the “very good” bracket. Data source: FICO (2024).