Looking to finance your next car purchase? As you shop around you may be wondering – do car dealers use FICO 9 for auto loans? The answer isn’t so simple. When you apply for an auto loan the dealer likely checks multiple credit scores from different bureaus. While it’s impossible to know exactly which scores they review, FICO 9 is a common one.

In this article, we’ll break down the key facts on credit scores and auto loans

- The different types of credit scores car dealers may use

- Why you can’t predict which exact scores are checked

- How scores like FICO 9 are calculated and what makes them unique

- Tips to optimize your credit before applying for an auto loan

Understanding these basics can help you evaluate your auto loan offers and interest rates. With some prep work, you can enter the car buying process confident your credit is in the best possible shape.

The Main Credit Scores Car Dealers Use

FICO and VantageScore are the two biggest names in the credit scoring business. Inside each model, there are various base scores and scores that are specific to the auto lending industry.

Here are some of the most common credit scores a dealer may review:

- FICO 8 and FICO 9: These base FICO scores aren’t designed just for auto lending, but lenders may use them anyway. FICO 9 is the newest version.

- FICO Auto Scores: These FICO versions are customized for predicting auto loan repayment. Your specific history with car loans is weighted heavily.

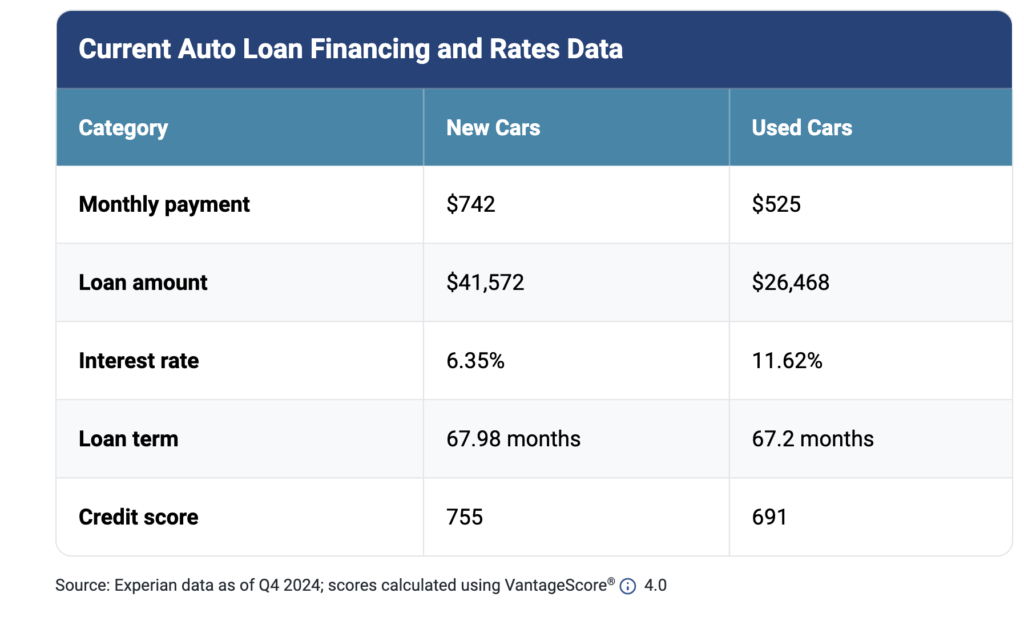

- VantageScore 3.0 and 4.0: The VantageScore models are used in over 70% of auto loan decisions, according to 2017 data.

In reality, it’s likely that the dealer doesn’t just look at one score. They might send your application to several lenders, and each of them might look at a different credit score. One lender may look at more than one score to get a full picture.

Why You Can’t Pinpoint the Exact Score Used

Given the variety of scores out there, you’re probably wondering – how can I find out my auto credit score? Unfortunately, it’s impossible to know for sure which score a lender will use. Here’s why:

- Variety of scoring models: FICO and VantageScore have released many different versions of their credit scores over the years. Lenders may use an older model.

- Custom industry scores: Scores tailored for auto lending, like the FICO Auto Score, are modified unpredictably.

- Multiple credit reports: Scores are based on one of your three credit reports. Different lenders may look at different reports.

- Range of lenders: The dealer may submit your application to several lenders, each of whom could use a different score.

The good news is that all of these scores are based on the same methods and factors. Things you do that raise your FICO 8 score are likely to also raise your VantageScore and FICO Auto Score.

Rather than fixating on one score, it’s better to focus on improving key aspects of your credit.

How FICO 9 Is Calculated and What Makes It Unique

To get the best credit score possible, it helps to know what makes up a FICO 9 score. Here are the basic components:

- Payment history (35%): Records of on-time payments, late payments, collections, and public records like bankruptcy.

- Credit utilization (30%): The amount of available credit you’re using. Lower utilization is better.

- Credit history length (15%): How long your credit accounts have been open. Longer is better.

- New credit (10%): How much new credit activity you have, including new accounts opened.

- Credit mix (10%): Whether you have experience with different account types, including credit cards, retail accounts, installment loans, and mortgages.

So how is the FICO 9 model unique from previous versions like FICO 8? Here are some key differences:

- Medical collections: FICO 9 ignores any medical collections under $500. This helps limit damage to scores from medical billing errors.

- Rent payments: If included on your credit report, FICO 9 factors in positive rent payment history. This can help consumers with limited credit history.

- Revolving credit limits: FICO 9 ignores installed but unused credit, like a credit limit increase you didn’t ask for. This helps prevent your utilization ratio from suddenly rising.

- Settled accounts: FICO 9 waits two years before counting a settled account as a positive, up from six months with older models.

Overall, the changes make FICO 9 more forgiving of certain credit report items that may not accurately reflect financial responsibility. However, the score still rewards the core healthy habits of on-time payments, low balances, and a diverse mix of accounts.

Tips to Improve Your Credit Before Applying for an Auto Loan

Since you don’t know exactly which credit scores an auto lender will review, your best bet is to optimize all of them. Here are some tips:

- Pay down balances: Lowering your overall credit utilization could give your score an immediate boost. Shoot for less than 30% across all cards.

- Consolidate debt: Combine multiple balances into one installment loan to decrease utilization. Personal loans don’t impact utilization like credit cards do.

- Keep old cards open: Don’t close unused cards as it can lower your overall credit limits and raise utilization.

- Hold off new applications: Each application can ding your score a few points initially. Avoid new credit inquiries leading up to an auto loan application.

- Check reports for errors: Dispute and remove any incorrect information that may be dragging your scores down.

- Continue on-time payments: Payment history is a huge factor, so keep all accounts in good standing.

With some strategic credit management in the months before auto loan shopping, you can put yourself in a great position to get approved and score the best rate.

The Bottom Line

While you can’t pin down the exact score an auto lender will use, scores like FICO 9 and others have similar methodology. Focusing on proven credit health tips can raise all your scores in tandem. With excellent credit, you’ll have the negotiating power to score the optimal auto financing terms and drive home in your dream car.

What is FICO® 8 Auto Score?

Fair Isaac Corporation (FICO) is a publicly traded data analytics company. You’re most likely familiar with their FICO score.

FICO offers specific products and solutions for car dealers and auto loans. Their product is called Auto Score 8. As you can see here from FICO’s promotional materials, Auto Score 8 is meant to help dealers assess credit risk and make approval decisions for auto loans. To answer the question ‘What credit score do car dealers use?” We need to dig into Auto Score 8, as it is in the industry standard credit score for auto loans.

Similar to your normal FICO score, you can request a copy of your current Auto Score from FICO for a fee.

What you really need to understand is that your Auto Score is calculated similarly, but differently than your traditional FICO score. The score range for the Auto Score is 250-900 (instead of the traditional 300-850). FICO promotes that Auto Score will help dealerships and lending institutions in five distinct ways:

- Increase regulatory compliance. With today’s shifting compliance landscape and the need to be more agile, it is more important than ever to have proper governance as well as explainability and fast auditability of all decisions made.

- Aggressively compete & meet portfolio objectives. FICO technology enables you to leverage machine learning and analytics to achieve your desired business outcomes and deliver highly compelling and personalized offers.

- Improve accuracy and speed of decision making. Increase your automatic approval rate with better customer knowledge, the most proven and predictive credit-risk scores, and a holistic understanding of the customer relationship over time.

- Combat financial crime. FICO can protect your business against emerging threats like synthetic fraud, traditional 1st and 3rd party fraud, and enterprise data breaches using artificial intelligence and machine learning.

- Improve customer and dealer loyalty. Today’s customer demands digital and multi-channel personalized engagement as well as a holistic view of their customer experience over time. Today’s auto dealers need complementary tools that enable them to better partner with you. Create value for everyone involved with the FICO platform.

3 things that impact your credit score

Regardless of if a dealership is using FICO® 8 Auto Score or CreditVision, my experience has taught me that there are three things that the banks and credit unions look at to determine your creditworthiness. They are, ability, stability and willingness.

Ability is defined by how much you earn and how much you payout on a monthly basis. In other words, do you have the ability based on your income to direct a certain percentage of that towards things like housing costs (mortgage or rent payments), car loans, and credit card payments?

Banks usually don’t want your debt payments to exceed more than 35 to 40% of your gross income. Say you earn $5,000 gross a month before taxes and deductions. The maximum amount of money banks would want to see you spending on debt is $2,000 per month.

This includes housing, cars and credit cards.

When you go to the dealer, ask yourself, “Do I have the ability, based off of what I earn and my current obligations, to take on additional debt?” That’s the question the dealer is asking themselves!

Stability is how long you have lived where you live, how long you have worked where you work, how long you’ve been employed in your line of work, and many other things of that nature.

Have you had three different addresses and four different jobs in the last three years? If you have, that would not show a bank stability. If you’re constantly moving and you’re having difficulty keeping a job for an extended period of time that could be a “red flag.”

Stability for the bank is someone who has resided at the same address for three years or longer, has been employed by the same employer for three years or longer, or has been employed in the same field for an even longer period of time.

Perhaps you’re a real estate agent and you’ve been in that line of work for 10 years. You’ve been with your present employer for three years, and you’ve lived at your current address for five years. That to a tee is stability.

You don’t move a lot, and you’ve been working in your industry for 10 years. To a car dealer or a bank, you don’t represent a big risk. If you have stability, you’re potentially the type of customer they are looking for, but that all depends on the last factor; willingness.

Willingness, is how you have handled your past debt obligations; mortgages, car loans, credit cards, phone bills and the like.

Have you paid them on time all the time or just some of the time? Have you paid them off ahead of schedule or did you fall behind schedule? If you fell behind schedule, how often did that happen? Did it happen once in three years or did it happen a dozen times in those three years?

Willingness signals to the bank exactly what kind of risk your loan poses to them.

If all of your accounts have always been paid on time or early, you are more than likely to get a loan quickly and easily because you pose little risk to the bank. If however you have a track record of paying your obligations off late, you immediately become riskier for the bank.

This generally translates into paying a higher interest rate. If the dealer or the bank is going to take the risk, they want to make money off of it. The greater the risk (less willing you’ve been in the past) the higher your rate of interest.

What Credit Score Do Car Dealerships Use? (Which Credit Bureau Is Most Used for Auto Loans?)

FAQ

Do car dealerships use FICO 9?

Base FICO Score: FICO stands for “Fair Isaac Corporation,” which is one of the most well-known places to get credit scores. The base FICO score is also called FICO Score 8 or 9. It’s not designed specifically for auto loans, but many lenders use it.

Is FICO 9 widely used?

According to the Fair Isaac Corporation, FICO Score 8 is still the most widely used version of the FICO score, and FICO Score 9 is also still widely used by lenders, even though both models have been available for over a decade.

Which credit score is used by car dealers?

FICO is an acronym that stands for: Fair Isaac Corporation, the company that developed the FICO® credit scoring. FICO® credit scores are the auto industry standard for determining a potential buyer’s creditworthiness.

Which FICO score is used for cars?

A FICO auto score is a credit scoring model designed just for the auto loan industry that lenders can use to evaluate loan applications. Like other FICO scoring models, FICO auto scores are calculated based on factors such as credit history and payment behavior.