The housing finance system in the United States involves various key players, including mortgage lenders, government agencies, and government-sponsored enterprises (GSEs). One common question that comes up is whether the Federal Housing Administration (FHA) is considered a GSE.

The short answer is no, the FHA is not technically considered a GSE. However, the FHA and GSEs like Fannie Mae and Freddie Mac work closely together to promote homeownership, especially for low-to-moderate income borrowers.

In this article, we’ll provide a comprehensive overview explaining what the FHA and GSEs are, how they differ, and how they coordinate to increase access to affordable mortgage credit.

What is the FHA?

First, let’s start with the FHA. The Department of Housing and Urban Development (HUD) is in charge of the Federal Housing Administration. It was set up in 1934 to help keep the housing market stable during the Great Depression by making it easier to get home loans.

The FHA insures mortgage loans made by approved lenders. This mortgage insurance protects lenders from losing money if a borrower doesn’t pay back the loan. People who borrow money pay an upfront and yearly mortgage insurance premium to the FHA in exchange for this insurance.

By offering this insurance, the FHA lets lenders give mortgages to people who might not be able to get a regular loan, like those with bad credit or a lot of debt compared to their income. When compared to conventional mortgages, FHA loans usually have less strict credit requirements and lower down payments.

What are GSEs?

Now let’s look at government-sponsored enterprises, commonly referred to as GSEs. GSEs are privately held financial services corporations created by Congress to help improve credit availability and liquidity in key sectors of the economy, especially housing.

GSEs help make mortgage loans possible by buying loans from other lenders on the secondary market. They are not direct lenders. Some of these loans are put together into mortgage-backed securities, which are then sold to investors. Lenders have more money to make new mortgage loans now that they have sold the loans.

The two most prominent GSEs in the housing finance system are Fannie Mae and Freddie Mac. Here is a quick overview of their roles:

-

Fannie Mae: Established in 1938 to help increase mortgage availability after the Great Depression. Fannie Mae purchases conventional loans that meet its underwriting guidelines from lenders and sells them on the secondary market.

-

Freddie Mac: Created in 1970 to give Fannie Mae competition and further expand access to mortgages. Like Fannie Mae, Freddie Mac buys mortgages on the secondary market and sells them as mortgage securities.

In essence, GSEs like Fannie Mae and Freddie Mac increase liquidity in the mortgage market and promote homeownership by buying loans from lenders and selling them to investors. Their guarantee of timely payment of principal and interest provides stability and attracts investment capital into the housing finance system.

Key Differences Between FHA and GSEs

While both the FHA and GSEs aim to facilitate homeownership, especially for underserved borrowers, there are some important differences between them:

-

Ownership Structure: The FHA is a government agency, while GSEs are privately owned corporations. However, Fannie Mae and Freddie Mac have been under government conservatorship since 2008.

-

Function: The FHA insures mortgages, taking on credit risk. GSEs buy and securitize mortgages, providing liquidity.

-

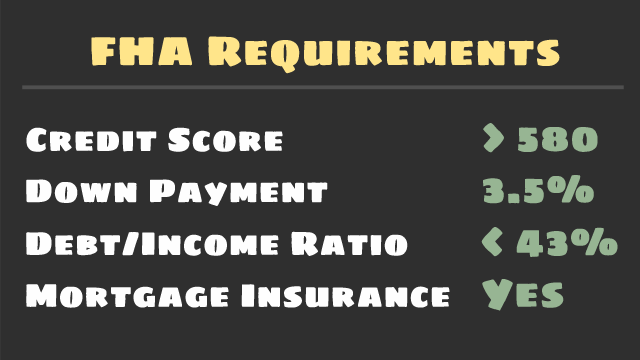

Mortgage Eligibility: The FHA insures loans that meet its criteria. GSEs buy loans adhering to their underwriting standards. FHA loans often have more flexible requirements than conventional loans bought by GSEs.

-

Borrower Type: The FHA tends to serve higher risk borrowers with lower credit scores and higher debt ratios. GSEs have tighter credit standards and serve more moderate-income borrowers.

-

Down Payment: FHA allows down payments as low as 3.5%. GSEs typically require at least 5% down for borrowers with credit scores below 720.

-

Mortgage Insurance: FHA borrowers pay annual mortgage insurance premiums directly to the FHA. Private mortgage insurance is required on conventional loans with less than 20% down.

Coordination Between FHA and GSEs

The FHA and GSEs both aim to serve low-to-moderate income and first-time homebuyers. This means there can be some overlap in their target borrower profiles. When one makes pricing changes, it can shift borrowers between FHA and GSE-backed loans.

For example, in 2023 the GSEs eliminated some loan-level pricing adjustments for lower income borrowers, while the FHA announced a reduction in annual mortgage insurance premiums. Such pricing changes help coordinate the relative competitiveness of FHA and conventional loans for targeted borrowers.

Beyond pricing coordination, the FHA and GSEs can also collaborate to increase access to credit by leveraging each other’s unique capabilities and strengths:

-

The GSEs can harness technology and use bank statement data to qualify more borrowers upfront who may not fit standard income documentation requirements.

-

The FHA can tap into its low-cost government capital to insure a greater share of riskier but still worthy borrowers.

-

The FHA can streamline processes and reduce lender concerns to attract more participation from large lenders and increase market competition.

-

The GSEs and FHA can jointly assess the impact of policy changes on expanding credit access to marginalized groups rather than only focusing on loan counts or volume.

Overall, a coordinated effort between the FHA and GSEs has significant potential to unlock homeownership opportunities for more low-income and first-time homebuyers who may not qualify through conventional channels alone. The unique offerings and capabilities of each entity are complementary in serving a wider spectrum of borrowers.

-

The FHA is a government agency that provides mortgage insurance, while GSEs are private corporations buying and securitizing mortgages.

-

The FHA serves higher-risk borrowers with more flexible credit requirements compared to the GSEs.

-

The FHA and GSEs make pricing changes to coordinate the competitiveness of FHA and conventional loans for targeted borrowers.

-

Further collaboration between the FHA and GSEs could greatly increase access to affordable mortgages by combining the strengths and capabilities of each entity.

So in conclusion, the FHA is not considered a GSE, but it works closely with GSEs to promote homeownership opportunities for credit-challenged and underserved borrowers. Coordinated efforts between the FHA and GSEs have the potential to unlock access to mortgages and enable more inclusive housing finance, especially for low-to-moderate income and first-time homebuyers.

How a Government-Sponsored Enterprise (GSE) Works

GSEs do not lend money to the public directly. Instead, they guarantee third-party loans and purchase loans in the secondary market, thereby providing money to lenders and financial institutions.

GSEs also issue short- and long-term bonds, referred to as agency bonds. The degree to which an agency bond issuer is considered independent of the federal government impacts the level of its default risk. Bond investors holding most, but not all, types of agency bonds have their interest payments exempt from state and local taxes. Fannie Mae and Freddie Mac bonds are not exempt from these taxes.

Although GSE bonds carry the implicit backing of the U.S. government, they are not guaranteed by the U.S. government. Unlike Treasury bonds, they are not direct obligations of the government. For this reason, these securities offer a slightly higher yield than Treasury bonds, since they have a somewhat higher degree of credit risk and default risk.

What Is a Government-Sponsored Enterprise (GSE)?

A government-sponsored enterprise (GSE) is a quasi-governmental entity established to enhance the flow of credit to specific sectors of the U.S. economy. Created by acts of Congress, these agencies—although they are privately held—provide public financial services. GSEs help to facilitate borrowing for a variety of individuals, including students, farmers, and homeowners.

For example, the Federal Home Loan Mortgage Corp. (Freddie Mac) was created as a GSE in the housing sector. It was intended to encourage homeownership among the middle and working classes. Freddie Mac is considered a mortgage GSE.

Another example of mortgage GSEs is the Federal National Mortgage Association (Fannie Mae). This entity was introduced to improve the flow of credit in the housing market (while also reducing the cost of that credit).

- A government-sponsored enterprise (GSE) is a quasi-governmental entity established to enhance the flow of credit to specific sectors of the U.S. economy.

- GSEs do not lend money to the public directly; instead, they guarantee third-party loans and purchase loans from lenders, ensuring liquidity.

- GSEs also issue short- and long-term bonds (agency bonds) that carry the implicit backing of the U.S. government.

- Fannie Mae and Freddie Mac are examples of government-sponsored enterprises.

Simple Explanation of Fannie Mae, Freddie Mac and FHA!

FAQ

What is the difference between FHA and GSE?

FHA stands for the Federal Housing Administration. GSE stands for Government-Sponsored Enterprise. By default, FHA home loans fall into the category of GSE loans. These home mortgages are constructed to help lower-credit home buyers and those with low income the ability to purchase a home. Is FHA a government-sponsored enterprise?.

What is a GSE loan?

The term GSE loan refers to a mortgage loan that conforms to the rules and standards of a GSE such as Federal Home Loan Banks (FHLB), Fannie Mae, Freddie Mac, or Farmer Mac. A private lender who agrees to follow GSE rules makes a GSE loan, not the GSE itself. What are the different GSEs in the mortgage industry?.

What is a government-sponsored enterprise (GSE) mortgage?

See how we rate mortgages to write unbiased product reviews. “Government-sponsored enterprise” (GSE) is a term you may not know well, but it’s likely that you or someone you know has dealt with a GSE company or the loan that they offer. GSEs buy and sell mortgage loans, and theyre the key to keeping the mortgage market afloat.

Are the FHA & GSE partners?

Remember that the FHA and the GSEs are not competitors; they work together to help more people become homeowners. They have the potential to significantly impact the lives of millions of Americans if they embrace this partnership and concentrate on their common objectives.

What are alternatives to GSE mortgages?

Common alternatives to GSE mortgages are government-backed loan programs like FHA, VA, and USDA loans. These tend to offer lower interest rates than conforming loans, and many will allow for even lower credit scores, too. These loans tend to have very specific qualifying requirements, though.

What are the different GSEs in the mortgage industry?

There are several different GSEs in the mortgage industry, including Federal Home Loan Banks, Fannie Mae, Freddie Mac and Farmer Mac. The Federal Home Loan Bank (FHLB) system is a GSE that was created by the Federal Home Loan Bank Act passed in 1932. It’s composed of 11 regional banks and 6,800 member financial institutions.

Is an FHA loan a GSE loan?

Another key GSE in the mortgage market is Ginnie Mae. It was founded in 1968 to guarantee government-backed loans. The two most common government-backed mortgages are: Federal Housing Administration (FHA) loans: Allow home buyers with lower credit scores or past credit issues to buy homes for 3.5% down.

Which is not a GSE?

Ginnie Mae, Fannie Mae and Freddie Mac are three organizations that are often collectively, but inaccurately, referred to as “agencies”. In fact, of the three, only Ginnie Mae is an agency that is fully backed by the U.S. government, while Fannie Mae and Freddie Mac are Government Sponsored Enterprises (“GSEs”).

What type of agency is the FHA?

The Federal Housing Administration (FHA) is part of the U.S. Department of Housing and Urban Development. We provide mortgage insurance on loans made by FHA-approved lenders.

What is considered a GSE loan?

A GSE mortgage is one that is purchased or guaranteed by government-sponsored enterprises such as Fannie Mae, Freddie Mac, or Ginnie Mae.Jul 22, 2024