Getting a mortgage is one of the biggest financial decisions you can make. Your credit score plays a key role in determining whether you’ll qualify for a home loan and the interest rate you’ll pay So where does a 732 credit score stand when applying for a mortgage?

Our in-depth guide will explain what credit scores mortgage lenders look for, how your score affects your rate, and most importantly, if a 732 FICO score is enough to get approved.

What Credit Score is Needed to Get a Mortgage?

The minimum credit score requirements for a mortgage vary by loan type

-

Conventional loans – Require a minimum score of 620 for standard financing with a down payment of at least 3%. Many lenders prefer scores of 680 or higher for the best rates.

-

FHA loans need a minimum score of 500 for a down payment of $10,000 and a score of 570 for a mortgage loan. 5.5% down, but most lenders want to see at least a 620 to approve the loan.

-

VA loans – Don’t have an official minimum score, but most lenders want to see at least a 620. No down payment required.

-

USDA loans – Don’t have a minimum credit score. But applicants still must meet income and debt-to-income requirements.

People with credit scores in the 500s or even lower may be able to get a mortgage, but they will likely have to pay more in interest and make a bigger down payment.

How Does Your Credit Score Affect Your Mortgage Rate?

In general, the higher your credit score, the lower mortgage rate you can qualify for. Lenders view borrowers with higher scores as lower risk.

According to myFICO, here’s how average mortgage rates differed by credit score range in early 2025:

- 760-850 credit score: 7.242% APR

- 700-759 credit score: 7.449% APR

- 680-699 credit score: 7.555% APR

- 660-679 credit score: 7.609% APR

- 640-659 credit score: 7.711% APR

- 620-639 credit score: 7.838% APR

For a $400,000 mortgage loan, the difference between a 760 credit score (excellent) and a 620 score (fair) could equal over $165 per month and $59,000 in extra interest paid over 30 years.

Is a 732 Credit Score Good Enough for a Mortgage?

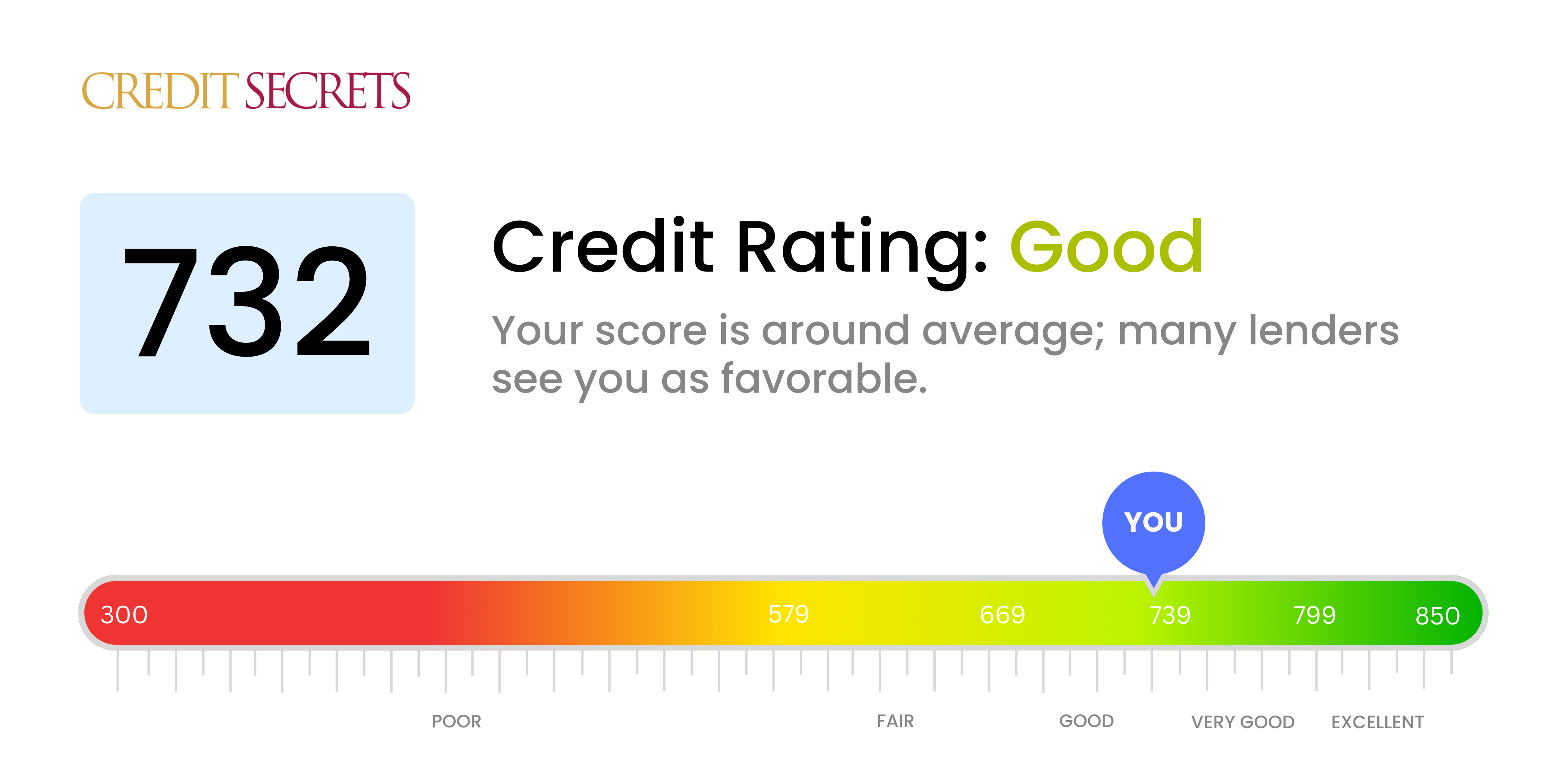

A 732 FICO score falls in the good credit range, though not excellent. According to FICO, it ranks at the 58th percentile, meaning about 58% of people have a lower score.

This 732 credit score exceeds most lenders’ minimum requirements. So you can likely qualify for a conventional, FHA, or VA loan.

However, with a 732 score you may not get the very lowest mortgage rates from top lenders. Those are often reserved for borrowers with scores of 760 or above.

Based on average interest rates, you can expect to pay about 0.2% higher rate with a 732 credit score compared to someone with a 760. On a $300,000 mortgage that equals about $50 more per month.

Strategies to Improve Your Chances with a 732 Credit Score

Though a 732 FICO is considered good, you still have room for improvement before reaching top-tier credit. Here are some tips to boost your mortgage approval odds:

-

Pay down debts to improve your debt-to-income ratio

-

Save for a larger down payment, ideally 20% to avoid private mortgage insurance

-

Check credit reports for errors and dispute inaccuracies

-

Don’t open new credit accounts right before applying for a mortgage

-

Ask your lender for a preapproval letter to lock in your rate

-

Compare mortgage rates from multiple lenders to find the best deals

With some strategic preparation, you can put yourself in a strong position to get approved for a competitive mortgage, even with credit scores in the low 700s.

The Bottom Line

A credit score of 732 is good enough to qualify for most mortgages, though you’ll likely pay a slightly higher interest rate than borrowers with excellent 750+ scores. Conventional loans generally require a 620 FICO minimum, while government-backed FHA and VA loans can go even lower.

To improve your chances, focus on lowering your debt-to-income ratio, saving for a larger down payment, and comparing rates across multiple lenders. With the right approach, a 732 credit score can still help you land a great mortgage. Just be prepared to shop around more than borrowers with exceptional scores above 760.

How mortgage lenders pull credit

When you apply for a mortgage, lenders pull your credit report from all three major credit bureaus: Transunion, Equifax, and Experian.

Whether you get approved for the loan—and the terms of your loan—will depend on the result of those reports.

Lenders qualify you based on your middle credit score.

- For example, if your scores are 720, 740, and 750, the lender will use 740 as your FICO.

- If your scores are 630, 690, and 690, the lender will use 690 as your FICO.

When you apply with a spouse or co-borrower, the lender will use the lower of the two applicants’ middle credit scores.

Expect each bureau to show a different FICO for you, since each will have slightly different information about you. And expect your mortgage FICO score to be lower than the VantageScore you’ll see in most free credit reporting apps.

In all cases, to accurately determine your credit score to buy a house, you will need to show at least one account that has been reporting a payment history for at least six months. This duration is necessary for the credit bureaus to have sufficient data to calculate a reliable score.

How to improve your credit score to buy a house

Homeownership is a dream for many, and it’s essential to understand the credit score needed to buy a house. Whether you are a first-time home buyer or looking to refinance, knowing what is a good credit score to buy a house can significantly influence your loan amount, interest rates, and the type of loan you qualify for.

You should start checking your credit early on in the home buying process, ideally 6–12 months before you want to buy a house. This will give you time to identify issues with your score or report and work on solving them before you apply for mortgage pre-approval.

Is 732 A Good Credit Score? – CreditGuide360.com

FAQ

Is a 732 credit score a good credit score?

A 732 credit score is considered a good credit score by many lenders. “Good” score range identified based on 2023 Credit Karma data. Lenders use your credit score to figure out how risky it is for them to lend you money. Credit scores are based on credit reports, which contain information about your credit history.

Is a 732 FICO ® score good?

A FICO® Score of 732 is Good, but if you can get it up to the Very Good range, you might be able to get better loan terms and lower interest rates. To get started, check your free credit report from Experian and find out the specific factors that impact your score the most.

Can a 740 credit score secure the lowest loan rates?

Even though rates are usually lowest for people with credit scores above 740, people with average credit may still be able to find good deals with some loan types. Remember, your credit score is just one piece of the puzzle. We need to look at all of your choices to make sure you get the best rate for your credit score.

What is the minimum credit score for a mortgage?

On paper, mortgages backed by the Federal Housing Administration — otherwise known as FHA loans — allow a minimum credit score of 500, so long as you’re making a 10% down payment. That’s about as low as it gets. However, with all types of mortgages, lenders can set their own minimum credit scores.

Can I get a mortgage if I don’t have a credit score?

If you’re just starting to consider a mortgage loan, you may not have talked to a lender yet, which means you may not have access to your official home buying credit report, which includes your individual credit score, or FICO score. Lenders are required to use a FICO score to meet loan qualifications for Fannie Mae, Freddie Mac, VA, FHA and USDA.

Are mortgage rates by credit score a one-size-fits-all?

Mortgage rates by credit score are not one-size-fits-all. While a credit score of 740 typically secures the lowest rates, borrowers with moderate credit may still find competitive options through specific loan types. Remember, your credit score is just one piece of the puzzle.

Is 732 a good credit score for a mortgage?

Lenders generally view those with credit scores of 670 and up as acceptable or lower-risk borrowers.

What credit score is needed for a $250000 house?

What credit score do I need to buy a $250,000 house? You can buy a $250,000 house with a wide range of credit scores, from as low as 500 to as high as 800+.Mar 19, 2025

What is the lowest credit score to get a mortgage?

The lowest credit score to buy a house typically starts at 500 for FHA loans with a higher down payment, while conventional loans often require a minimum score of 620. Knowing the lowest credit score to buy a house can help you assess your options and take steps to improve your financial standing.

How rare is credit score over 800?

What it means to have a credit score of 800. A credit score of 800 means you have an exceptional credit score, according to Experian. According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.