Your credit score is one of the most important numbers in your financial life It gives lenders an idea of how likely you are to repay debts, and can affect everything from loan terms to credit card interest rates So what does it mean if you have a 675 credit score? Is that considered good or bad?

In this comprehensive guide we’ll explain everything you need to know about 675 credit scores including

- What a 675 credit score means

- The factors that make up your score

- How your score impacts your ability to get credit

- Tips for improving a 675 credit score

What Does a 675 Credit Score Mean?

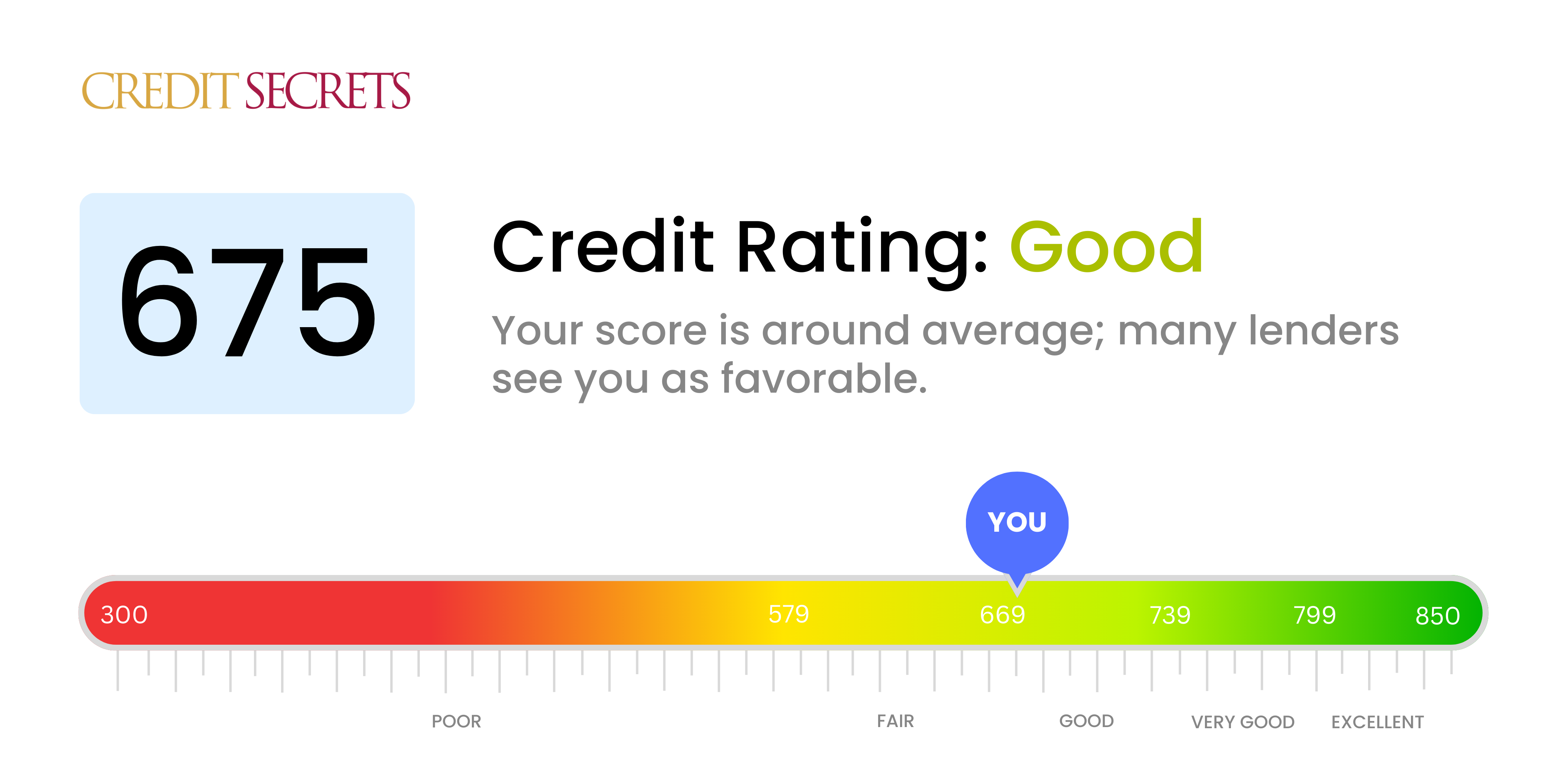

A 675 credit score falls in the “good” credit range on the FICO and VantageScore scoring models, which are the two most commonly used scores.

A score between 670 and 739 on the FICO model, which goes from 300 to 850, is good. On the VantageScore scale, which ranges from 300 to 850, a score of 661 to 780 is good.

So while a 675 isn’t an exceptional score, it does signify that you manage credit responsibly. You pay your bills on time, maintain a reasonable credit utilization rate, and have established length of credit history.

About 61 percent of consumers have credit scores between 675 and 800. Lenders usually think that people with credit scores of 675 are good credit applicants and will give them a range of credit products. But people with higher scores might get better rates and terms.

What Makes Up Your Credit Score

Credit scores take into account five main factors:

-

Payment history (35%) – Your track record of on-time payments and any delinquencies, bankruptcies or collections. The most influential factor.

-

Credit utilization (30%) – The ratio of credit you’re using compared to your limits. Using too much hurts scores.

-

Length of credit history (15%) – How long you’ve had credit accounts opened. More history helps.

-

Total accounts (10%) – The number and diversity of accounts you have. A healthy mix is best.

-

New credit inquiries (10%) – Opening new accounts may lower scores temporarily.

Payment history and credit utilization together make up about 65% of your score. For a 675 score, you likely have a decent history of on-time payments, though you may carry moderately high balances on credit cards or other revolving debt.

How a 675 Credit Score Affects Your Borrowing Power

You can get most loans and credit cards with a credit score of 675, but you might not get the best terms. This is what might happen if you get a 675:

Credit cards – You’ll likely qualify for an unsecured card, but may pay higher interest rates and annual fees. Rewards cards may be out of reach. Your credit limit may start lower.

Auto loans – Approval is possible, but expect to pay higher interest rates or a larger down payment requirement. Shopping around for better rates is key.

Mortgages – Getting a conventional mortgage will be challenging. You may need an FHA, VA or USDA-backed loan requiring a smaller down payment but with higher rates.

Personal loans: You can get one, but you’ll have to pay more in fees and interest than people with better credit. Compare lenders to find the best rates.

The bottom line is that while a 675 credit score makes borrowing possible, it pays to improve your score if you want access to more affordable loan terms. But all hope is not lost with a 675 score. Let’s look at ways to raise it.

How to Improve a 675 Credit Score

Boosting your 675 score into the “good” or even “excellent” ranges is possible with some time and discipline. Here are key tips:

-

Lower credit utilization – Get balances below 30% of your credit limits to help scores increase over time. Pay down balances aggressively if you can.

-

Pay all bills on time – Delinquencies hurt, so set up autopay or reminders to avoid missed payments. Bring any past-due accounts current.

-

Don’t close old accounts – Keeping longtime credit cards open preserves the length of your credit history.

-

Limit hard inquiries – Too many credit checks from loan or card applications in a short period can lower scores temporarily. Comparison shop within a 14-day period to minimize the impact.

-

Check credit reports – Verify all information is correct and dispute any errors with the credit bureaus to remove mistakes weighing down your scores.

-

Practice patience – Building credit takes time. Focus on developing long-term healthy habits and your 675 score will start climbing. Monitor your scores monthly to gauge progress.

Improving your credit score gives you access to better rates that save you money over the long haul. For example, boosting your score into the “good” range could mean paying $100 less per month on a mortgage or car loan. That’s over $40,000 in savings on a 30-year mortgage!

Summing Up the 675 Credit Score

A 675 credit score puts you in decent financial shape, but you still have room for improvement. The higher you can boost your score, the more money you can potentially save by qualifying for better loan terms.

Focus on paying bills on time, lowering balances, and limiting credit inquiries. With diligence and patience, you can achieve an “excellent” score unlocking your most affordable borrowing options. Monitor your credit scores regularly to ensure you’re on the right track.

Improving your credit is a marathon, not a sprint. But with persistence and developing healthy money management habits, a great credit score is within your reach.

Maintaining your Good credit score

Your 690 credit score puts you solidly in the mainstream of American consumer credit profiles, but some additional time and effort can raise your score into the Very Good range (740-799) or even the Exceptional range (800-850). To keep up your progress and avoid losing ground, steer clear of behaviors that can lower your credit score.

Factors that affect your credit score include:

Payment history. Delinquent accounts and late or missed payments can harm your credit score. A history of paying your bills on time will help your credit score. Its pretty straightforward, and its the single biggest influence on your credit score, accounting for as much as 35% of your FICO® Score.

Credit usage rate. To determine your credit utilization ratio, add up the balances on your revolving credit accounts (such as credit cards) and divide the result by your total credit limit. If you owe $4,000 on your credit cards and have a total credit limit of $10,000, for instance, your credit utilization rate is 40%. You probably know your credit score will suffer if you “max out” your credit limit by pushing utilization toward 100%, but you may not know that most experts recommend keeping your utilization ratio below 30% to avoid lowering your credit scores. Credit usage is responsible for about 30% of your FICO® Score.

Length of credit history. Credit scores generally benefit from longer credit histories. Theres not much new credit users can do about that, except avoid bad habits and work to establish a track record of timely payments and good credit decisions. Length of credit history can constitute up to 15% of your FICO® Score.

Total debt and credit. Credit scores reflect your total amount of outstanding debt you have, and the types of credit you use. The FICO® Score tends to favor a variety of credit, including both installment loans (i.e., loans with fixed payments and a set repayment schedule, such as mortgages and car loans) and revolving credit (i.e., accounts such as credit cards that let you borrow within a specific credit limit and repay using variable payments). Credit mix can influence up to 10% of your FICO® Score.

Recent applications. When you apply for a loan or credit card, you trigger a process known as a hard inquiry, in which the lender requests your credit score (and often your credit report as well). A hard inquiry typically has a short-term negative effect on your credit score. As long as you continue to make timely payments, your credit score typically rebounds quickly from the effects of hard inquiries. (Checking your own credit is a soft inquiry and does not impact your credit score.) Recent credit activity can account for up to 10% of your FICO® Score.

How to improve your 675 Credit Score

A FICO® Score of 675 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an even greater number, at more affordable lending terms.

Additionally, because a 675 FICO® Score is on the lower end of the Good range, youll probably want to manage your score carefully to prevent dropping into the more restrictive Fair credit score range (580 to 669).

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, youll receive information about ways you can boost your score, based on specific information in your credit file. Youll find some good general score-improvement tips here.

What Is A 675 Credit Score? – CreditGuide360.com

FAQ

Is a credit score of 675 ok?

A 675 credit score is considered ”good” by the two main scoring models. You may take out loans and apply for credit cards with a 675 credit score. You might be able to raise your credit score if you pay your bills on time every month and lower the amount of credit you use.

What is a good excellent credit score?

A good credit score typically falls in the mid-600s to mid-700s on the commonly used 300-850 credit score range. Most of the time, scores in the high 700s and above are good, while scores in the low 600s to mid-500s are fair. Scores between 300 to low 500s fall into the bad credit score range.

How rare is a 750 credit score?

A credit score of 750 is considered “very good” and is above the average credit score in the United States. While it’s not as rare as an exceptional score of 800 or higher, it still places you in a relatively strong position with lenders.

What credit score is needed for a $250000 house?

What credit score do I need to buy a $250,000 house? Credit scores as low as 500 and as high as 800 can all be used to buy a $250,000 house. Mar 19, 2025.