Can I Buy a House If I Owe the IRS?

Buying a house is an exciting milestone in life. However, it can be complicated if you have outstanding tax debt owed to the IRS. Many homebuyers wonder – can I buy a house if I owe the IRS?

Long story short, you can buy a house even if you owe the IRS money. However, there are some important things to think about and actions you can take to raise your chances of getting a mortgage loan.

You can read this article to learn more about how tax debt can affect your plans to buy a house, how lenders find out about IRS debt, and most importantly, how to get rid of tax debt so you can buy your dream home.

How Tax Debt Impacts Buying a House

When applying for a mortgage lenders will carefully analyze your finances to determine if you are a good credit risk. Any outstanding debts you have including unpaid taxes owed to the IRS, will be scrutinized.

There are three main ways tax debt can negatively impact your mortgage application:

-

It affects your debt-to-income ratio. Tax debt counts toward your total existing monthly debts. With a high DTI, lenders see you as a more risky borrower.

-

It signals financial irresponsibility if unresolved. Ignored or unmanaged tax debt is a red flag to lenders.

-

The IRS has first claim on your assets. If you default, the IRS gets paid before the mortgage lender.

How Lenders Find Out About Tax Debt

Lenders dig deep into your finances during the mortgage application process. Here are some of the ways they uncover tax debt:

-

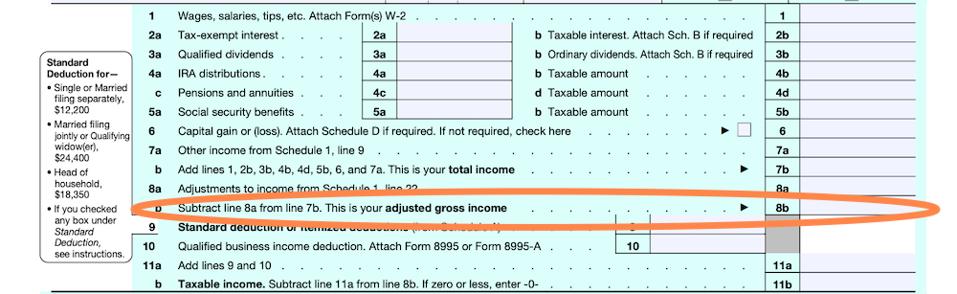

Going over your tax returns—Lenders need copies of your most recent returns to see proof of income and look for unpaid tax bills.

-

Credit reports – While tax debt doesn’t show up on your credit report, public tax liens and judgments will.

-

Title search – A title search of the property will reveal any IRS tax liens filed.

-

Financial disclosures – You are legally required to disclose all debts and liabilities, including any owed taxes.

-

Income and asset verification – Lenders verify all details of your financial profile, including debts owed.

Strategies for Buying a House When You Have Tax Debt

If you owe back taxes to the IRS, here are some tips that can help your chances of getting approved for a mortgage:

-

Communicate with the IRS – Set up a payment plan or negotiate a settlement. Show lenders you’re addressing it.

-

Pay off tax debt – If possible, pay off all IRS debt prior to applying for a mortgage.

-

Meet payment plan terms – If you have a payment plan, be current on payments and make at least one payment before closing.

-

Remove tax liens – Work to get any tax liens removed from your record prior to applying.

-

Know lender policies – Each lender has policies on approving mortgages with tax debt. Ask upfront.

-

Improve other factors – Bolster your credit, income, assets and down payment to offset the risk.

-

Explore FHA loans – FHA loans can be more lenient toward tax debt if you meet their guidelines.

-

Consult a tax professional – Tax attorneys can help negotiate settlements and navigate complex IRS rules.

How to Remove Tax Liens

If the IRS has filed a tax lien against you, it can severely hurt your mortgage approval odds. Here are some potential options for removing a tax lien:

-

Pay off the tax debt in full – The IRS will remove the lien once the debt is paid.

-

Apply for Currently Not Collectible status – This pauses IRS collection efforts including liens.

-

Prove undue hardship – Demonstrate paying the debt would cause undue financial hardship.

-

Apply for an Offer in Compromise – Settle your tax debt for less than the full amount.

-

Request lien withdrawal – File Form 12277 Application for Withdrawal to request removal.

-

Request lien subordination – Ask the IRS to make its claim secondary to the mortgage lender.

-

File for bankruptcy – This can remove tax liens but has major long-term consequences.

Setting Up an IRS Payment Plan

If you can’t pay your tax debt in full, setting up an IRS payment plan can help avoid liens being filed or remove existing ones. The IRS offers:

-

Short-term payment plan – Full payment within 120 days, for balances under $100K. No setup fees.

-

Long-term payment plan – Monthly payments over 72 months for balances under $50K. Setup fees apply.

-

Offer in Compromise – Lump sum or payment plan for less than full amount owed, if you meet criteria.

Tips for First-Time Home Buyers with Tax Debt

As a first-time home buyer, tax debt can feel like an added obstacle to overcome. Here are some tips:

-

Prioritize resolving your tax debt and getting in good standing with the IRS before applying for a mortgage. This will expand your lender options.

-

If you can’t fully resolve the tax debt beforehand, setup an IRS payment plan. Making consistent on-time payments will show responsibility.

-

FHA loans can offer more flexibility regarding tax debt than conventional mortgages. Just be sure you meet all their other guidelines.

-

Look into first-time home buyer programs. Some may offer specialized mortgage products or down payment assistance to offset tax debt challenges.

-

Work on improving all other aspects of your financial profile – income, savings, credit score, etc. A stronger application can help offset the tax debt.

-

Full transparency about your tax debt situation is essential. Don’t hide anything from your loan officer. They can advise you on solutions.

The Bottom Line

Unpaid taxes owed to the IRS can make getting a mortgage more difficult but not impossible. The keys are addressing your tax debt responsibly, being upfront with lenders, and taking steps to improve your financial standing. If you strategically tackle your tax debt, you can still achieve the dream of homeownership. Consult with tax professionals for personalized advice and solutions.

Clearing Your Tax Dues as a Priority

If you have a tax liability and want to prioritize its settlement, there are several steps you can take to effectively manage the situation. It is important to assess your current financial situation, including your income, expenses and savings. Understanding your financial situation will help you develop a plan to pay off your tax dues.

Once you have assessed your financial situation, it is important to review the tax penalties that have been applied to your taxes owed. Familiarizing yourself with the specific penalties and interest and their amounts will allow you to create a payment strategy.

Maintaining open communication with the tax authorities is essential. You should contact them to discuss your situation and explore possible options. In many cases, tax authorities offer Installment Agreements that allow you to settle your tax dues in monthly installments. These agreements require regular payments over an extended period of time. Talk to the tax authorities to learn the terms and conditions of this type of agreement and determine if it is appropriate for your situation.

Another option to consider is an Offer in Compromise. Depending on your financial circumstances, you may qualify for an Offer in Compromise. This option allows you to settle your tax dues for less than the full amount owed. However, proof of financial hardship is generally required. Consult with the tax authorities or a tax professional to determine if you are eligible for this program.

To prioritize paying off your tax liability, you may want to adjust your budget. Look for areas where you can temporarily or permanently reduce expenses to allocate more funds for tax payments.

Determining the Problem: Tax Lien or Tax Liability?

When you are faced with a housing tax-related problem, it is essential to determine whether it is a tax lien or a tax liability. This distinction will help you understand the problem and find appropriate solutions.

A tax lien refers to a legal claim that the government makes on a property due to unpaid taxes. This lien gives the government the right to seize the property to pay off the due taxes. If there is a tax lien on the property, this can complicate the home buying process and may need to be resolved before proceeding.

On the other hand, tax liability refers to the amount of money owed to the tax authorities, either at the local or federal level, due to unpaid taxes and which hasn’t necessarily ended up as a tax lien on your property. This liability can arise for a variety of reasons, such as underpayments, errors on tax returns, or failure to file returns at all. It is important to determine the extent of the tax liabilityand how it may affect the mortgage application process.

When applying for a mortgage or loan, lenders typically evaluate the applicant’s financial situation, including tax liabilities. Any outstanding taxes or tax lien may affect the approval process and may require resolution before proceeding with the loan application.

Can I Owe The IRS and Still Get a Mortgage?

FAQ

Does owing the IRS affect buying a house?

A tax lien can cause a significant drop in your credit scores, making it harder for you to secure favorable mortgage loans. Additionally, if a tax lien is filed against you, it’s public information and will appear on your credit reports, making it known to potential lenders that you have unpaid taxes.

Can you get an FHA loan if you owe the IRS?

Can I buy a house if I am on a payment plan with the IRS?

Fannie Mae (Conventional): IRS payment plans are allowed, but the monthly payment must be included in your debt-to-income (DTI) ratio. Freddie Mac (Conventional): Payment plans are permitted, with the monthly amount factored into your DTI ratio.

Can I get a mortgage if I owe state taxes?

Tax dues, especially if unresolved, can result in federal or state tax liens. These liens can affect your assets, including property, and affect your financial situation. Lenders may view tax liens as a risk and may be reluctant to grant a mortgage until the liens are resolved.