Getting rid of debt can be good for your credit score and bad for it at the same time. On the one hand, paying your bills on time and getting rid of debt are both smart money moves that should improve your creditworthiness. On the other hand, your score is also affected by things like the types of credit you have and how long you’ve had credit. So getting rid of a debt might sometimes make your credit score go down.

Confusing, right? Let’s break it down so you understand exactly how paying in full affects your credit

How Credit Scores Are Calculated

What makes up your credit score is the first thing you need to know. One or two scoring models are used by most lenders, but FICO and VantageScore are the two most common.

These businesses look at your credit report and give you a three-digit score that tells them how creditworthy you are. The higher the number the lower lending risk you pose.

There are five major factors that influence your credit score:

- Payment history – Have you paid your bills on time? Late payments can seriously damage your score.

- Amounts owed – This revolves around your credit utilization ratio and how much you currently owe compared to your total available credit.

- Length of credit history – In general, the longer your credit accounts have been open, the better.

- New credit – Opening a lot of new accounts in a short period can indicate higher risk and hurt your score.

- Credit mix – Having different types of credit – like credit cards, installment loans, and a mortgage – can help your score.

So when you pay off a debt in full it doesn’t automatically mean your credit score will increase. The payoff could change some of these key influencing factors in ways that lower your score.

Why Scores Could Drop After Debt Payoff

One reason why paying off a debt in full might make your credit score go down for a short time is:

-

Credit utilization – Paying off a credit card or other revolving line of credit lowers your total balances owed, which reduces your credit utilization ratio. Great news, right? Not if it was your only account or your main source of available credit. Eliminating your largest line or closing your only credit source could actually increase your utilization across remaining accounts.

-

Credit mix – If the paid-off loan was your sole installment loan – like an auto, student, or mortgage loan – then your credit mix narrows. Creditors like to see you can manage different types of credit responsibly.

-

Length of history – Along the same lines, if the installment loan you paid off was also your oldest credit account, your length of credit history shortens when it’s closed. Age of accounts is an important factor.

-

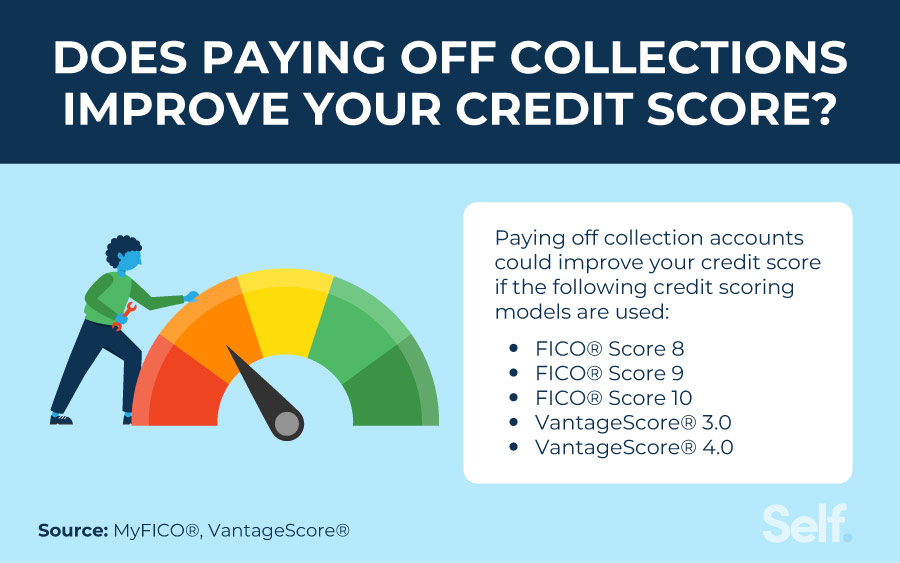

Scoring model – Depending on the credit scoring model used, paid collections or settlements may or may not impact your score. For example, VantageScore ignores all paid collections when calculating your score. But with a FICO model, any collections can ding your score for years, even if paid.

In many cases, these dings to your credit score are temporary and should rebound in a matter of months as you continue practicing good credit behaviors. However, credit mix and history can have longer-lasting impacts.

When Paying Debts Helps Your Credit Score

Paying off debt doesn’t always lower your credit score. Here are some cases when it could give your score a boost:

-

Eliminating collections – If you had accounts in collections that you pay off, newer credit scoring models will ignore them. This can help raise scores calculated with versions like VantageScore 4.0 or FICO 10.

-

Paying over time – Making consecutive on-time payments over months or years builds your credit through positive payment history. Paying off the balance ultimately shows lenders you can be trusted.

-

Lowering balances – Paying down credit card or revolving debt decreases your credit utilization ratio, especially if you eliminate cards entirely. This can help improve your score.

-

Removing missed payments – Catching up on late or missed payments through payoff stops the bleeding. No more damage will occur, and on-time history can start accruing.

Overall, it’s better to pay off debts in full if you can afford it, even if your credit score drops initially. You’ll save on interest, avoid collections, and strengthen your finances in the long run.

Tips for Raising Your Credit Score

If you see your credit score drop after paying a debt, don’t panic. Here are some tips for improving it going forward:

-

Make all bill payments on time. Delinquencies severely hurt your score, so prompt payment is key.

-

Keep balances low on credit cards and lines of credit. High utilization damages your score, so try to keep it under 30%.

-

Hold onto installment loans if possible. Don’t close your oldest credit sources if you can avoid it.

-

Limit new credit applications. Too many hard inquiries from applying for new credit makes lenders cautious.

-

Wait for time to pass. The impact of changes to your history and utilization fade over a few months.

-

Correct errors on your credit report. Mistakes could be tanking your score, so dispute any inaccuracies.

-

Practice good money habits. Budgeting, saving, and being a responsible borrower will benefit your finances and creditworthiness.

The Takeaway

Will paying a debt in full increase your credit score? Not necessarily. In some cases, it might cause your score to temporarily drop due to shifts in your credit utilization, history length, or mix. But avoiding interest and getting out of debt is still smart financially.

Pay off debts you can, keep practicing good credit habits, and your score should rebound or continue improving over time. Payoff might cause a slight initial dip, but the long run benefits are well worth it.

When will my credit scores improve after paying off my debts?

Paying off debt is more likely to help your credit scores than to hurt them. You are likely to see your credit scores improve after paying off debt unless the debt you repaid meets the unique criteria listed above.

What elements affect my credit scores?

To better understand why you could see lower credit scores after paying off debt, consider the elements that go into calculating your scores.

Your credit scores are based on information from your credit reports, which are generated by each of the three nationwide consumer reporting agencies (CRAs). The nationwide CRAs — Equifax, TransUnion and Experian — receive information about your lines of credit such as personal loans, credit cards and auto and mortgage loans.

Your credit scores are then calculated based on a formula that determines your creditworthiness, or how likely you are to make your debt payments on time. Credit scores are one factor that lenders may consider when deciding whether to extend credit to you.

There are many formulas used to calculate credit scores. However, most consider the following factors:

- Payment history. Your payment history shows how you have repaid credit in the past. Certain behaviors, such as late or missed payments, can have a negative impact on your scores.

- Length of credit history. Your credit reports track the amount of time your credit accounts have been active. A longer credit history can have a positive effect on your scores.

- Newer lines of credit. Any recent credit accounts you have opened are also taken into consideration when calculating your credit scores.

- Credit mix. Your mix of credit accounts — including loans, credit cards and mortgages — is generally considered when calculating your scores, and a diverse credit portfolio can have a favorable impact.

- Credit utilization ratio. The amount of revolving credit you’re using divided by the total credit available to you is known as your credit utilization ratio and can also have an impact on your scores.

Paying Collections – Dave Ramsey Rant

FAQ

Will my credit score go up if I pay in full?

Paying off your credit card debt each month is one of the most consistent ways to help improve your credit scores.

How many points will my credit score increase if a collection is paid in full?

How Much Will Credit Score Increase After Paying off Collections? Your credit score may not increase at all when you pay off collections. However, if your debt is reported using a newer credit scoring model, your score may increase by however many points were impacted by the collections debt.

Will a paid-in full collection help my credit score?

… collections: VantageScore 3. 0 and 4. 0 don’t punish paid collections, so if you pay off a collections account in full, it will help your scoresJan 7, 2025

Does paying your credit card in full improve credit score?

Most of the time, paying off your credit card in full is the best approach. Carrying a balance on your credit card does not help your credit score. Doing so can also result in extra fees and interest charges.