Having a credit score of 550 can make getting approved for a personal loan more challenging. However there are some lenders that may still approve borrowers with poor credit scores. Here is an overview of how big of a loan you may be able to qualify for with a 550 credit score.

What Credit Score Is Considered 550?

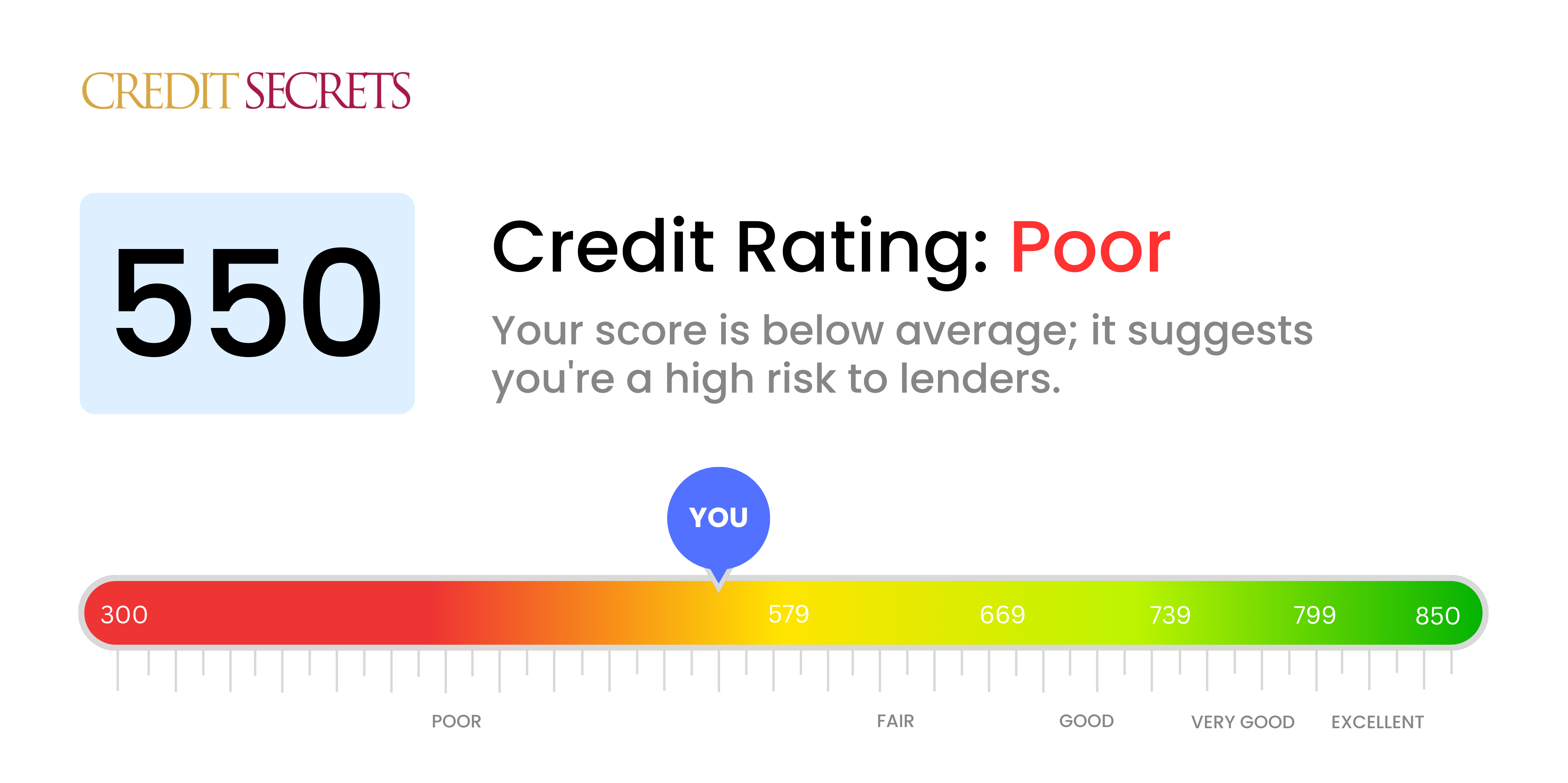

Credit scores range from 300 to 850. Scores are grouped into categories that indicate your creditworthiness. The following is how the FICO credit score model breaks down the score ranges:

- 300 to 579 – Poor/Bad

- 580 to 669 – Fair

- 670 to 739 – Good

- 740 to 799 – Very good

- 800 to 850 – Exceptional

There are 560 people with FICO scores that are considered to have poor or bad credit. Only 13 percent of consumers have credit scores below 2058. Lenders see people with scores in this range as a high risk.

Can You Get a Loan with a 550 Credit Score?

Most lenders want applicants with at least fair credit, which starts at 580. However, some lenders may accept applicants with lower scores. For example, specialty lenders that offer bad credit loans often accept applicants with scores as low as 550.

Lenders that may consider applicants with 550 credit scores include:

- <g-bubble><span><span>Avant</span></span><div><span><div>Avant</div><div>Avant, LLC, formerly AvantCredit, is <b>a private Chicago, Illinois-based company in the financial technology industry</b>. The company was established in 2012 by serial entrepreneur Albert “Al” Goldstein, John Sun, and Paul Zhang.</div><div><div><img src=”https://encrypted-tbn2.gstatic.com/favicon-tbn?q=tbn:ANd9GcTCJ566l0c77iwS08IyHpadT6wOk4inNXeacuZee85ZaAI9B67GcMy6qATqt36uvPnp_7Ux0OQppMJTUmzu4F7K4DnKbLlbSTzPpSXM”/><div><div><cite>https://en.wikipedia.org</cite></div></div></div><div><div><span><a href=”https://en.wikipedia.org/wiki/Avant_(company)”>Avant (company) – Wikipedia<span></span></a></span></div></div></div></span><button></button></div></g-bubble> – Minimum score 550, max loan $35,000

- OneMain Financial – No minimum score, max loan $20,000

- Upgrade – Minimum score 560, max loan $50,000

While approval is possible, you will likely pay much higher interest rates and fees compared to borrowers with good credit. Lenders view poor credit as high risk so they charge more to try to offset potential losses from defaults.

What is the Maximum Loan Amount for 550 Credit?

The max loan amount you can qualify for with a 550 credit score depends on the lender. Some lenders that may approve borrowers with 550 credit include:

- <g-bubble><span><span>Avant</span></span><div><span><div>Avant</div><div>Avant, LLC, formerly AvantCredit, is <b>a private Chicago, Illinois-based company in the financial technology industry</b>. The company was established in 2012 by serial entrepreneur Albert “Al” Goldstein, John Sun, and Paul Zhang.</div><div><div><img src=”https://encrypted-tbn2.gstatic.com/favicon-tbn?q=tbn:ANd9GcTCJ566l0c77iwS08IyHpadT6wOk4inNXeacuZee85ZaAI9B67GcMy6qATqt36uvPnp_7Ux0OQppMJTUmzu4F7K4DnKbLlbSTzPpSXM”/><div><div><cite>https://en.wikipedia.org</cite></div></div></div><div><div><span><a href=”https://en.wikipedia.org/wiki/Avant_(company)”>Avant (company) – Wikipedia<span></span></a></span></div></div></div></span><button></button></div></g-bubble> – Up to $35,000

- OneMain Financial – Up to $20,000

- Upgrade – Up to $50,000

The maximums above are for unsecured personal loans. With a secured loan, where you put up collateral like a car or savings account, you may be able to qualify for a larger loan amount despite having poor credit.

Tips for Getting the Most Funding with 550 Credit

Here are some tips that may help you get approved for the maximum loan amount possible with a credit score of 550:

-

Apply with lenders that specialize in bad credit loans. They will be more likely to approve you than mainstream banks and credit unions.

-

You might want to get a co-signer with good credit to help you get the loan. Their better credit can help you get a loan with better terms.

-

Apply for a secured loan and put up an asset as collateral. This reduces the lender’s risk so they may approve you for more funds.

-

Make sure to provide proof of steady income with your application. Lenders want to see you can afford the monthly payments.

-

Only apply for the amount you need rather than maxing out what you qualify for. Asking for less may increase approval odds.

-

Be prepared to accept a shorter repayment term, which results in higher monthly payments but allows you to borrow more.

With poor credit, you will have fewer options and may need to accept less desirable terms. But shop around and use the strategies above to optimize your chances of getting approved for the biggest loan possible with a 550 score.

A credit score of 550 is considered bad, but some lenders may still approve you for a personal loan despite the poor credit. Specialty lenders like <g-bubble><span><span>Avant</span></span><div><span><div>Avant</div><div>Avant, LLC, formerly AvantCredit, is <b>a private Chicago, Illinois-based company in the financial technology industry</b>. The company was established in 2012 by serial entrepreneur Albert “Al” Goldstein, John Sun, and Paul Zhang.</div><div><div><img src=”https://encrypted-tbn2.gstatic.com/favicon-tbn?q=tbn:ANd9GcTCJ566l0c77iwS08IyHpadT6wOk4inNXeacuZee85ZaAI9B67GcMy6qATqt36uvPnp_7Ux0OQppMJTUmzu4F7K4DnKbLlbSTzPpSXM”/><div><div><cite>https://en.wikipedia.org</cite></div></div></div><div><div><span><a href=”https://en.wikipedia.org/wiki/Avant_(company)”>Avant (company) – Wikipedia<span></span></a></span></div></div></div></span><button></button></div></g-bubble> and OneMain Financial may lend up to $35,000 or $20,000 with a 550 credit score. Your maximum loan amount will depend on factors like income, existing debt levels, and whether you offer collateral. With poor credit, focus on finding a lender that will approve you and provide the funding you need.

Lenders with loans for bad credit

Avant personal loans are a good choice for borrowers with bad credit looking for small- to moderate-sized personal loans. Loans are available up to $35,000 and you could get the money as soon as the next business day after approval. Plus, Avant is more likely than some lenders to approve the applications of borrowers whove prequalified with Avant. However, the lender charges an origination fee up to 9.99%, and its top-range interest rates are among the highest of the lenders we reviewed.

- Borrowers with bad credit considered

- Funds as soon as the next business day

- 2-year loan terms available

- No discounts offered

- Origination fee

- Not available in HI, IA, MA, ME, NY, VT, WV, WA, AP, AE, and AA

Origination fee, late fee, dishonored payment fee

Available in all states except HI, IA, MA, ME, NY, VT, WV, WA, AP, AE, and AA

Time to get funds

As soon as the next business day (if approved by 4:30 p.m. CT on a weekday)

Debt consolidation, emergency expense, life event, home improvement, and other purposes

2 to 5 years

Reprise may be an excellent option if you need a loan with bad credit. The lender says it will consider applicants with FICO scores as low as 560, and offers secured loans as well as some cosigned loans to help you qualify. Loan funds can be available the next business day once you’re approved. Plus, the company has a 4.7 Trustpilot rating — indicating generally satisfied customers.

But Reprise is not for everyone. Available loan amounts are relatively low at $25,000, and the minimum repayment term is relatively high at three years. The lender also charges origination fees, does not offer discounts, and is not available nationwide.

- Loans for bad credit

- 4.7 Trustpilot rating

- Secured loans available

- Cosigners considered

- Next-day funding available

- Easy to contact

- Does not accept self-employment income as a primary source of income

- Minimum 3-year loan term

- Relatively low maximum loan amount ($25,000)

- Origination fees up to 6%

- Not available nationwide

- No mobile app

- No discounts for autopay or direct pay

3 to 5 years

$15 late fee except where the state has a different limit (ie. NM), return payment fees – $20 except where state has a different limit (ie – NM), and no prepayment penalty

Unavailable in CO, CT, HI, IA, ME, MD, MA, NV, NJ, NY, SD, VT, WA, and WV

Time to get funds

1-7 business days depending on loan security type

Credit card refinancing, debt consolidation, emergencies, major purchases, medical and dental expenses, moving expenses, special occasions, unexpected expenses, vacation and travel

Universal Credit offers loan amounts up to $50,000, repayment terms up to seven years, and discounts for direct pay and autopay. Funds are available as soon as the next business day after loan approval.

Note that rates and fees can be relatively high — you may pay an origination fee from 5.25% to 9.99%, and APRs start at 11.69%. If you get a loan with a high interest rate, consider refinancing your personal loan at a lower rate once youve improved your credit score.

- Borrowers with low credit scores considered

- $25,000 annual income requirement

- Autopay and direct pay discounts available

- Can fund in one business day

- High APRs

- Potentially high origination fees

- Not available in Iowa

3, 5, or 7 years

Autopay and direct pay

Available in all states

Time to get funds

As soon as 1 business day after acceptance

Debt consolidation, pay off credit cards, home improvements, unexpected expenses, home and auto repairs, weddings, and other major purchases

OneMain Financial has multiple options for bad-credit personal loans. There is no minimum credit score required (if you apply directly with OneMain), which means you could get a loan with bad credit (FICO below 580). Plus, cosigners are allowed — a cosigner is someone (ideally, with good credit) who promises to repay the loan if you cant, which can make it easier to qualify or lower your rate. And, secured personal loans are available. You secure a loan with collateral, which may also help you qualify or lower your rate.

Rates are higher than competitors and OneMain charges origination fees as either a flat fee up to $500, or a percentage from 1% to 10% (depending on your state of residence). Note that even if you prequalify for a personal loan with OneMain, getting approved isnt a given.

- Flexible eligibility requirements

- Offers secured options

- Competitive bad-credit loans

- Physical presence

- Availability

- Origination fees

- High starting APR

- Low maximum loan amount

Origination fee, unsuccessful payment fee, late fee

Must have photo I.D. issued by U.S. federal, state or local government

Time to get funds

As soon as 1 to 2 days after acceptance

All except business, and education

Avant personal loans are a good choice for borrowers with bad credit looking for small- to moderate-sized personal loans. Loans are available up to $35,000 and you could get the money as soon as the next business day after approval. Plus, Avant is more likely than some lenders to approve the applications of borrowers whove prequalified with Avant. However, the lender charges an origination fee up to 9.99%, and its top-range interest rates are among the highest of the lenders we reviewed.

- Borrowers with bad credit considered

- Funds as soon as the next business day

- 2-year loan terms available

- No discounts offered

- Origination fee

- Not available in HI, IA, MA, ME, NY, VT, WV, WA, AP, AE, and AA

Origination fee, late fee, dishonored payment fee

Available in all states except HI, IA, MA, ME, NY, VT, WV, WA, AP, AE, and AA

Time to get funds

As soon as the next business day (if approved by 4:30 p.m. CT on a weekday)

Debt consolidation, emergency expense, life event, home improvement, and other purposes

2 to 5 years

Reprise may be an excellent option if you need a loan with bad credit. The lender says it will consider applicants with FICO scores as low as 560, and offers secured loans as well as some cosigned loans to help you qualify. Loan funds can be available the next business day once you’re approved. Plus, the company has a 4.7 Trustpilot rating — indicating generally satisfied customers.

But Reprise is not for everyone. Available loan amounts are relatively low at $25,000, and the minimum repayment term is relatively high at three years. The lender also charges origination fees, does not offer discounts, and is not available nationwide.

- Loans for bad credit

- 4.7 Trustpilot rating

- Secured loans available

- Cosigners considered

- Next-day funding available

- Easy to contact

- Does not accept self-employment income as a primary source of income

- Minimum 3-year loan term

- Relatively low maximum loan amount ($25,000)

- Origination fees up to 6%

- Not available nationwide

- No mobile app

- No discounts for autopay or direct pay

3 to 5 years

$15 late fee except where the state has a different limit (ie. NM), return payment fees – $20 except where state has a different limit (ie – NM), and no prepayment penalty

Unavailable in CO, CT, HI, IA, ME, MD, MA, NV, NJ, NY, SD, VT, WA, and WV

Time to get funds

1-7 business days depending on loan security type

Credit card refinancing, debt consolidation, emergencies, major purchases, medical and dental expenses, moving expenses, special occasions, unexpected expenses, vacation and travel

Universal Credit offers loan amounts up to $50,000, repayment terms up to seven years, and discounts for direct pay and autopay. Funds are available as soon as the next business day after loan approval.

Note that rates and fees can be relatively high — you may pay an origination fee from 5.25% to 9.99%, and APRs start at 11.69%. If you get a loan with a high interest rate, consider refinancing your personal loan at a lower rate once youve improved your credit score.

- Borrowers with low credit scores considered

- $25,000 annual income requirement

- Autopay and direct pay discounts available

- Can fund in one business day

- High APRs

- Potentially high origination fees

- Not available in Iowa

3, 5, or 7 years

Autopay and direct pay

Available in all states

Time to get funds

As soon as 1 business day after acceptance

Debt consolidation, pay off credit cards, home improvements, unexpected expenses, home and auto repairs, weddings, and other major purchases

OneMain Financial has multiple options for bad-credit personal loans. There is no minimum credit score required (if you apply directly with OneMain), which means you could get a loan with bad credit (FICO below 580). Plus, cosigners are allowed — a cosigner is someone (ideally, with good credit) who promises to repay the loan if you cant, which can make it easier to qualify or lower your rate. And, secured personal loans are available. You secure a loan with collateral, which may also help you qualify or lower your rate.

Rates are higher than competitors and OneMain charges origination fees as either a flat fee up to $500, or a percentage from 1% to 10% (depending on your state of residence). Note that even if you prequalify for a personal loan with OneMain, getting approved isnt a given.

- Flexible eligibility requirements

- Offers secured options

- Competitive bad-credit loans

- Physical presence

- Availability

- Origination fees

- High starting APR

- Low maximum loan amount

Origination fee, unsuccessful payment fee, late fee

Must have photo I.D. issued by U.S. federal, state or local government

Time to get funds

As soon as 1 to 2 days after acceptance

All except business, and education

The Credible editorial team is independent and unbiased — we base ratings on a data-driven process and apply rating algorithms uniformly to ensure fair comparisons between lenders. We never get paid to rank products or lending partners.

Our expert editorial staff analyzed 899 personal loan data points across 31 lenders assessing rates, fees, customer experience, and more to simplify your personal loan comparison. For a deeper dive into our process, see our detailed methodology.

Credible has a 4.8 out of 5 star rating with Trustpilot, based on over 8,000 reviews.

How to improve your credit score

One of the best ways to get a loan with bad credit is to improve your credit score. The best way for long-lasting gains is to make your monthly payments on time and keep credit card balances low.

- Consistently pay bills on time: Payment history is the most important factor in calculating your FICO credit score. Set up automatic payments for recurring bills like car payments, credit cards, and personal loans. If a number of your bills are due around the same time each month, reach out to your creditors to change due dates for more breathing room.

- Pay down debt: The amount of debt you owe contributes 30% to your FICO score. Paying down debt, especially credit card debt, can positively impact your credit and your ability to qualify for a personal loan.

- Become an authorized user: If you have a family member or close friend with good credit who’s willing to make you an authorized user on one of their credit cards, you can benefit from their good credit. The account would be entered on your credit report, which means their history of positive payments and available credit would be as well. Both can significantly boost your credit score.

- Don’t close credit card accounts: Closing old credit card accounts with a zero balance may seem like a good idea, but it can drastically increase your credit utilization, which can hurt your credit. Credit utilization represents the amount of revolving credit you’re using relative to the amount available to you. Keeping accounts open once you’ve paid off balances can be a good way to keep your credit utilization ratio low and improve your score.

- Avoid hard inquiries: A hard inquiry often occurs when you formally apply for a loan. A lender may see you as a risk if you seek to borrow money multiple times from different sources within a short period of time. Applications for new credit make up 10% of your credit score.

How big of a loan you can get with a 550 credit score? BCL

FAQ

Can I get a personal loan with a 550 credit score?

You can get a personal loan with a 550 credit score, but your choices are very limited. The best way to get a personal loan with a 550 credit score is to start by checking to see if you pre-qualify for loans from major lenders.

What are interest rates for personal loans with a 550 credit score?

Borrowers with a credit score of 550 might face interest rates as high as 35% when applying for personal loans. This is due to the perceived risk to lenders.

What does a credit score of 550 indicate?

A credit score of 550 falls in the poor credit category, indicating higher risk. However, having a score in this range doesn’t mean you’re completely shut out of getting a loan if you need one. You have some options if you’re looking for lenders that offer personal loans for a credit score of 550.

What are alternatives to personal loans for a credit score under 550?

Another alternative option to personal loans for a credit score under 550 is a payday loan. These loans are basically an advance on your paycheck and can help you get cash fast. However, payday loans typically have extremely high interest and they need to be repaid quickly—typically within weeks.

What are the easiest loans to get with a 550 credit score?

Student loans are some of the easiest loans to get with a 550 credit score, seeing as nearly 25% of them are given to applicants with a credit score below 540. A new degree may also make it easier to repay the loan if it leads to more income. Note: Borrower percentages above reflect Q3 2017 Equifax data.

Should you get a payday loan with a 550 credit score?

Payday loans may seem like a good idea if you have a credit score of 550 and are having trouble getting personal loans. But they’re usually not. Payday loans are short-term loans that provide you cash to hold you over until your next paycheck.

How much can you borrow with a 550 credit score?

Top Lenders for 550 Credit Score Personal LoansLenderMinimum Credit ScoreLoan AmountAvant580Up to $35,000OneMain FinancialNo minimumUp to $20,000LendingClub600Up to $40,000Upstart620Up to $50,000.

What credit score is needed for a $5000 loan?

For a $5,000 loan, most lenders typically require a credit score of at least 580, which is considered a fair credit score. Most of the time, though, people with credit scores of 640 or higher get the best loan terms and lowest interest rates.

What can you get approved for with a 550 credit score?

Some lenders don’t have strict credit requirements, so you can get a loan even if your credit score is only 550. Keep in mind that the lower your credit score, the higher your personal loan interest rate will be. Consider using a cosigner or applying for a secured loan to increase your approval odds.

What credit score is needed to buy a $300K house?