Having a credit score of 671 can feel like you’re stuck in credit score purgatory – not quite bad but not quite good either. So is a 671 credit score actually good? The short answer is no. While a score of 671 is fair, it falls short of what most lenders consider a good credit score. But don’t worry, there are still plenty of things you can do to improve your score and unlock better rates and opportunities.

What Does A 671 Credit Score Mean?

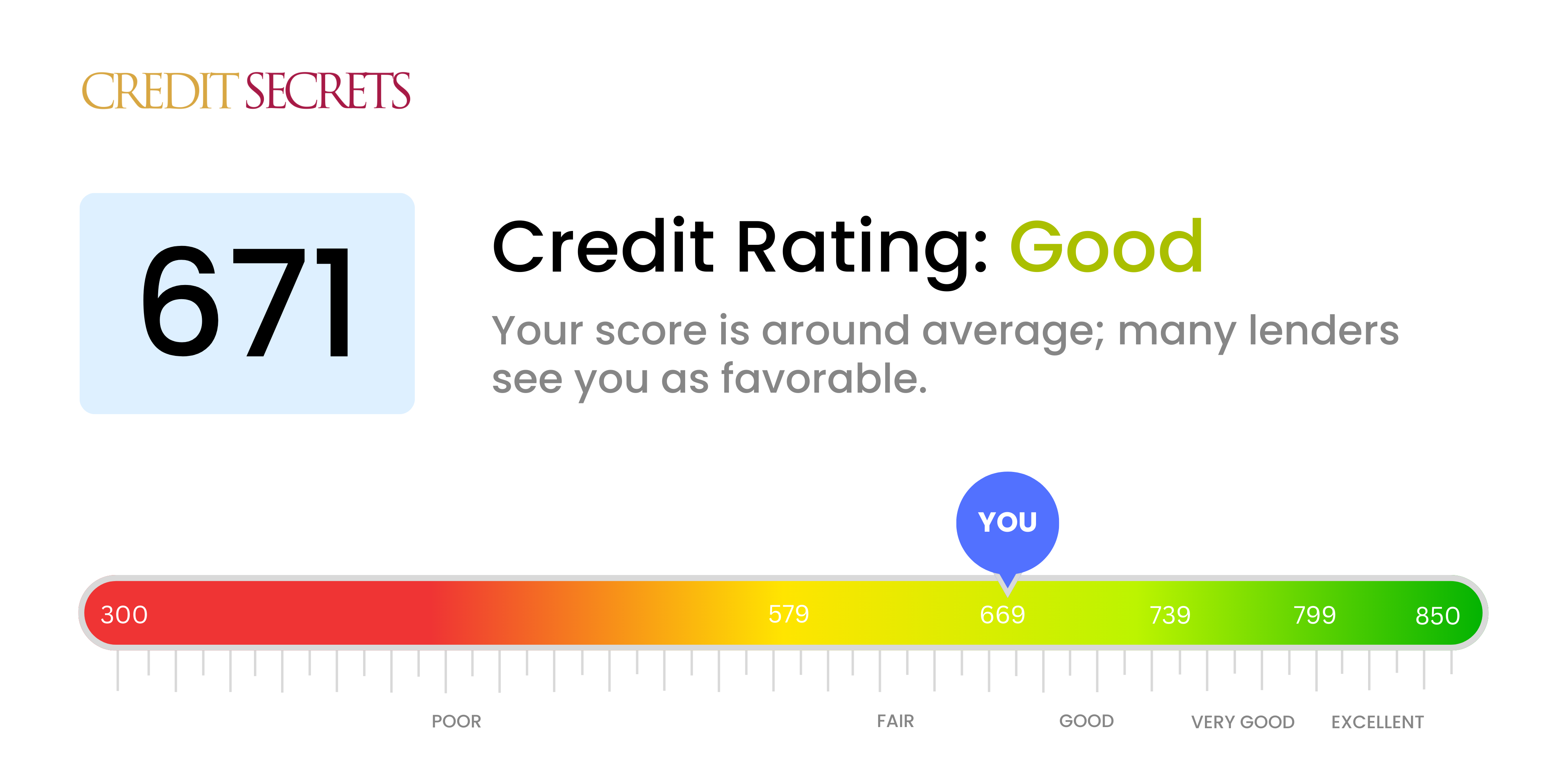

Credit scores range from 300 to 850. They are broken down into the following categories:

- 800-850: Exceptional

- 740-799: Very Good

- 670-739: Good

- 580-669: Fair

- 300-579: Very Poor

You’re in the right range with a score of 671. In the US, the average credit score is around 716, so you’ll need to do some work to get yours above that number and into the good range.

Lenders will still give you credit if your score is 671, but you probably won’t get the best terms or rates. Lenders think that people with fair credit are a bigger risk, so you’ll have to pay more in fees and interest. You might not be able to get the best rewards credit cards or loans with the lowest rates advertised either.

What Credit Can You Get With A 671 Score?

Here are some examples of the credit options and terms you can expect with a 671 credit score

-

Credit Cards – You can qualify for an unsecured card, but it likely won’t offer robust rewards or a 0% intro APR. Expect credit limits around $500 to $1,000 to start.

-

Auto Loans – You can get approved but will pay higher interest rates, around 8-14% for a new car loan and 14-20% for used.

-

Mortgages: An FHA loan is possible if you have at least a 3. 5 percent down payment if your debt-to-income ratio is 23 percent or less Interest rates will be higher than those with good credit.

-

Personal Loans – Approval will be challenging and you’ll pay higher rates if approved, possibly 17% or more.

-

Student Loans – No problem being approved, but interest rates will be higher than those with good credit.

If your credit score is 671, you can still get credit, but the terms won’t be as good. You can, however, take steps to raise your score and get it into the good range.

How to Improve Your 671 Credit Score

Improving your credit score takes time and discipline, but it’s doable if you stay focused. Here are some tips to get you started:

-

Pay all bills on time. Payment history has the biggest impact on your scores. Set up autopay if you tend to forget due dates.

-

Lower credit utilization. Owing more than 30% of your limit can hurt your score. Pay down balances and ask for credit line increases.

-

Avoid new credit applications. Too many hard inquiries in a short timeframe can ding your score. Only apply for credit you need.

-

Check for errors on your credit reports. Incorrect information can unfairly lower your scores. Dispute any errors with the credit bureaus.

-

Don’t close old accounts. Keeping accounts open helps your credit mix and history length. Leave old accounts open if there’s no annual fee.

-

Become an authorized user. Ask a friend or family member with good credit to add you as an authorized user to help build your history.

-

Use credit builder products. Secured cards, credit builder loans, and experiential programs can help establish positive payment habits.

With diligence and smart credit management, you can boost your 671 score into the good credit range within 6 to 12 months. Be patient and don’t get discouraged if your score dips along the way. As long as you stay focused on positive credit behaviors, your score will rebound and improve.

Who Has A 671 Credit Score?

There isn’t one specific profile for someone with a 671 credit score. People across different demographics – age, income, geographic location – can have scores in the fair range for different reasons. Here are some examples of borrowers who may have a 671 score:

-

Young adults/students – Due to limited credit history from being new to credit.

-

Low to middle income – Struggle with on-time payments or high credit utilization.

-

Credit mis-steps – Late payments, collections, or high debt burden damaged their score.

-

Going through hardship – Job loss, medical bills, divorce caused financial and score setbacks.

-

Building credit – Recent immigrants or those with no FICO score yet.

-

Focused on improvement – Past credit mistakes but now practicing good habits.

Your personal situation and credit history will determine what’s weighing down your credit score. By analyzing your credit reports and FICO or VantageScore factors, you can pinpoint where you need to focus most to boost your score.

Tips to Reach a Good Credit Score

Improving your credit takes effort, but it’s one of the best things you can do for your overall financial health. Here are some smart tips to move from fair to good credit:

-

Review your credit reports for errors – Dispute anything that seems wrong or outdated.

-

Get a secured credit card – Make on-time payments to establish positive history.

-

Limit hard inquiries – Only apply for credit you truly need to avoid too many inquiries.

-

Pay more than the minimum – Pay down balances aggressively to lower your utilization.

-

Automate payments – Set up autopay so you never miss payment due dates.

-

Don’t close old accounts – Keeping accounts open helps your history length and mix.

-

Ask for credit line increases – More available credit lowers your overall utilization.

-

Mix credit types – Have installment loans like mortgages along with credit cards.

-

Give it time – Improving scores takes patience and consistently good habits.

While a 671 score may not get you the best rates right now, you’re not far from crossing over into good credit territory. With focus and perseverance, you can get your score above 700 within a year or so. Don’t get discouraged by small dips along the way – as long as you stay committed to building your credit, your hard work will pay off with higher scores and unlocked opportunities.

What is the average credit score?

As of January 2024 the average credit score in the United States was 701. While this is the average credit score, it falls in the Fair Range.

What are credit score ranges and what is a good credit score?

Credit score ranges vary depending on the scoring model. Higher credit scores mean you have demonstrated responsible credit behavior in the past, which may make potential lenders and creditors more confident when evaluating a request for credit. Most credit score ranges are similar to the following:

- 800 to 850: Excellent Credit Score Individuals in this range are considered to be low-risk borrowers. They may have an easier time securing a loan than borrowers with lower scores.

- 740 to 799: Very Good Credit Score Individuals in this range have demonstrated a history of positive credit behavior and may have an easier time being approved for additional credit.

- 670 to 739: Good Credit Score Lenders generally view those with credit scores of 670 and up as acceptable or lower-risk borrowers.

- 580 to 669: Fair Credit Score Individuals in this category are often considered “subprime” borrowers. Lenders may consider them higher-risk, and they may have trouble qualifying for new credit.

- 300 to 579: Poor Credit Score Individuals in this range often have difficulty being approved for new credit. If you find yourself in the poor category, its likely youll need to take steps to improve your credit scores before you can secure any new credit.

Lenders use credit scores along with a variety of other types of information — such as information you provide on the credit application (for example: income, how long you have lived at your residence, and other banking relationships you may have) in their loan evaluation process. Different lenders have different criteria when it comes to granting credit. That means the credit scores they accept may vary depending on their criteria.

Score providers, such as the three nationwide credit reporting agencies (NCRAs)—Equifax®, Experian® and TransUnion®—and companies like FICO® use different types of credit scoring models and may use different information to calculate credit scores. Therefore, credit scores may be different from each other. Not all creditors and lenders report to all credit score providers.

Is A 671 Credit Score Good? – CreditGuide360.com

FAQ

Is 671 a good credit score?

Your credit score of 671 is about average for American consumers. However, with a little more work and time, you can raise it to the Very Good range (740–799) or even the Exceptional range (800–850). Stay away from things that can hurt your credit score if you don’t want to lose ground and keep making progress.

Is a 671 FICO score good?

A FICO® Score of 671 is Good, but if you can get it to be in the Very Good range, you might be able to get better loan terms and lower interest rates. Checking your credit score to see what factors have the most impact on it is a good place to start. You can get your free credit report from Experian.

Can you get a student loan with a 671 credit score?

Student loans are some of the easiest loans to get with a 671 credit score, seeing as more than 60% of them are given to applicants with a credit score below 700. A new degree may also make it easier to repay the loan if it leads to more income.

What can a 671 credit score get you?

A FICO® Score of 671 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an even greater number, at more affordable lending terms.

Is 700 a very good credit score?

What is considered a good credit score? A good credit score is within the range of 661-780 based on the VantageScore® 3.0 scoring model.Mar 13, 2025

Can I buy a house with a 671 credit score?

Yes, you should be able to buy a house with a 671 credit score. The minimum threshold for a conventional mortgage is 620, so a 671 score puts you in good standing. You’ll also need steady employment and income and enough money for a down payment.

How rare is an 800 credit score?

An 800 credit score is relatively rare, with approximately 23% of Americans achieving this “exceptional” FICO score range (800-850), according to The Motley Fool.