The FICO Score 9 is the latest version of the widely used FICO credit score. It was introduced in 2014 and has some key differences from previous FICO versions that could benefit consumers. But over 5 years later, which lenders are actually using FICO 9 for credit decisions? Let’s take a detailed look.

What is FICO Score 9?

The FICO Score is developed by the Fair Isaac Corporation to assess a person’s credit risk. It is calculated from information in your credit report and ranges from 300 to 850. The higher the score, the lower the perceived credit risk.

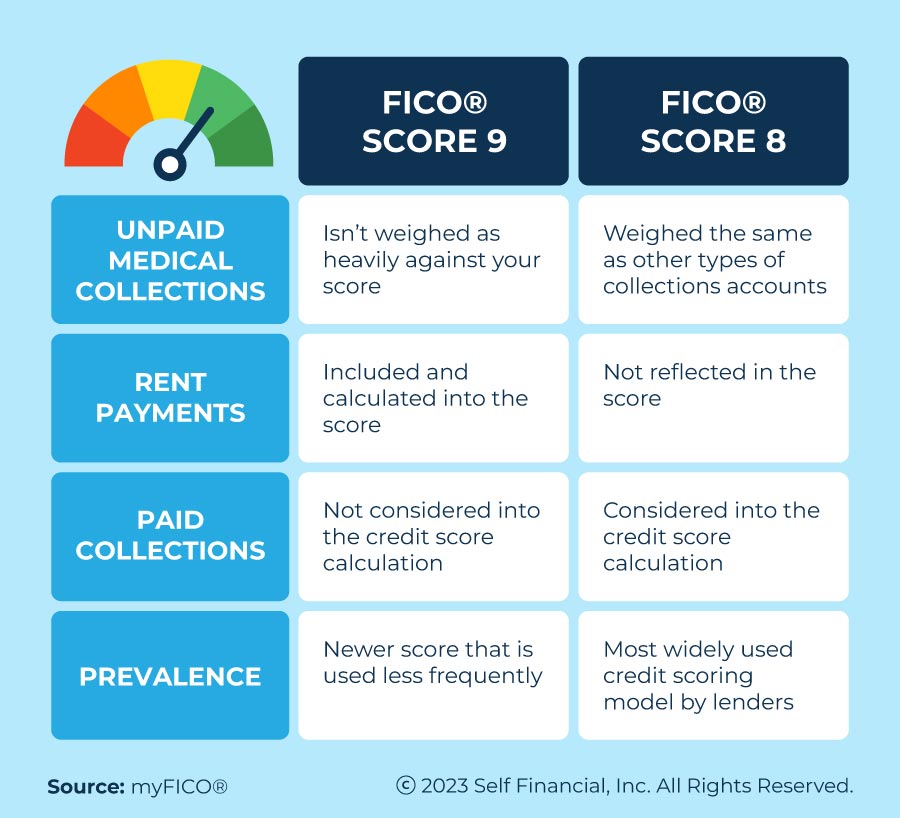

FICO regularly updates their credit scoring models, The FICO Score 9 is the newest version and was released to lenders in 2014 Here are some of the key changes in FICO 9 compared to previous versions like FICO 8

- Medical debts have less impact on the score. Unpaid medical debts will be discounted in the scoring formula.

- Paid collections are ignored. If you’ve paid a debt that went to collections, it will no longer negatively impact your FICO 9 score.

- Rental payment history can be considered. If landlords report on-time rent payments, it can help build your credit history.

The FICO 9 score is now more flexible for many people, especially when it comes to medical debt and collections. People with thin credit files, like young borrowers or new immigrants, may also see their scores go up because of rental information.

Mortgage Lenders Lagging Behind on FICO 9 Adoption

The mortgage business has been very slow to adopt FICO 9. A lot of mortgage lenders still use older versions of the FICO score, like FICO 2, 4, and 5, for their underwriting.

Why isn’t it used more? Mortgage lending is heavily regulated, and lenders tend to be cautious when they look at risk. Fannie Mae and Freddie Mac, two government-backed companies, have not yet changed their underwriting standards to let FICO 9 scores be used. Because of this, lenders won’t switch until the GSEs say so.

Fannie and Freddie have said they want to switch to FICO 9 in the future. But for now, all conventional mortgages and government-backed mortgages (FHA, USDA, and VA loans) still use older versions of the FICO score.

The only lenders using FICO 9 for mortgages are ones making portfolio loans, meaning they keep the loan on their books rather than selling to the secondary market. These lenders are few and far between.

Credit Cards and Personal Loans Moving to FICO 9

While mortgage lenders are slow on the uptake, other lending categories like credit cards and personal loans are much quicker to adopt new scoring models. These types of lenders routinely use the latest FICO versions like 8 and 9 for underwriting decisions.

For example, major credit card issuers like American Express, Bank of America, Capital One, Chase, Citi, and Wells Fargo are known to use FICO 8 and 9. The same is true for large personal loan lenders like Marcus by Goldman Sachs, Lightstream, and SoFi.

The reason for faster adoption among unsecured lenders is less regulation and portfolio lending practices. Credit card and personal loan balances stay on the lender’s books, so they can freely choose risk models without GSE oversight. And they are more motivated to use the latest credit data and technology.

Auto Lenders Split Between FICO 8 and FICO Auto Scores

The auto lending industry sits somewhere in the middle between slow-moving mortgages and fast-adopting credit cards. Many major auto lenders now use FICO Score 8 or 9 for underwriting. But a sizable portion still relies on industry-specific FICO Auto Scores, which trail the regular FICO versions.

For example, the FICO Auto Score 8 is more prevalent than the regular FICO 8 or FICO 9 in auto lending decisions. But some lenders like Bank of America and Capital One pull regular FICO scores for auto loans.

The benefit of using FICO Auto Scores is they are tailored for the unique needs of auto lending. But the downside is they incorporate new credit data more slowly than regular FICO versions. So consumers with very recent changes on their credit reports may get better outcomes with lenders using FICO 8 or 9.

How to Check Which FICO Version Your Lenders Use

The variation between lenders in terms of which FICO score versions they rely on can be confusing for consumers. Here are some tips on how to check which FICO score model your lenders are actually using:

- Review loan documents – Any lender using a credit score for underwriting must disclose which score they used in your final loan documents.

- Check your credit report – Many credit reports will list FICO score versions that lenders have pulled in the last 12 months.

- Ask lender reps – Reaching out to customer service reps is the most direct way to get info on their credit score practices.

- Google research – Search “[lender name] fico score version” to find consumer forum posts and articles on specific lender practices.

Doing a bit of legwork can give you confidence on which FICO score version carries the most weight for any given lender. Focusing on maximizing the right score for your most important lending relationships pays dividends.

The Bottom Line

While the FICO Score 9 aims to provide a more holistic and forgiving assessment of creditworthiness, adoption remains mixed several years after its release. Mortgage lenders still lag far behind, while credit card issuers lead the way.

As a consumer, it pays to understand which credit score versions your go-to lenders rely on. Check your loan paperwork and research lender practices, so you can focus on optimizing the FICO score(s) that matter most for your financial situation. Monitoring your credit reports and scores is invaluable in building and maintaining great credit.

When will lenders use it?

The scoring company reported in 2023 that FICO 8 and FICO 9 are the most widely used models by all three of the major credit bureaus.

How the FICO Score 9 is different

- Medical debt. Health care-related debt has less of an impact on the score than other types of debt. About 15 million Americans have medical debt on their credit reports, according to the Consumer Financial Protection Bureau. FICOs latest scoring model gives that debt less weight than, say, credit card debt.

- Paid collections. Collections accounts that have been paid in full are disregarded in score calculations. (This is also true for FICOs newest versions — FICO 10 and FICO 10T.)

- Rent payments. If rent payments are reported, they are part of the score calculations. Before now, rent payments were added to credit reports but werent used to calculate a FICO credit score (they were, however, used for VantageScore 3.0).

What is the FICO 9 score 2023? | FICO Score 9: What You Need to Know? | Fico score 9 meaning

FAQ

Does anyone use FICO score 9?

FICO scores 8 and 9 are commonly used for student loans, personal loans, medical loans, credit card lines and auto loans.

Do banks use FICO 8 or 9?

According to the Fair Isaac Corporation, FICO Score 8 is still the most widely used version of the FICO score, and FICO Score 9 is also still widely used by lenders, even though both models have been available for over a decade.

Do dealerships use FICO 9?

The base FICO score is also called FICO Score 8 or 9. It’s not designed specifically for auto loans, but many lenders use it. It’s a number between 300 and 850, and a higher score means that a person is more likely to make loan payments on time.

Do landlords use FICO 9?

Senate Bill 1157 is in effect until July 1, 2025, and allows landlords to report FICO 9, FICO 10, and VantageScore 3. 0 and 4. 0 credit scores.